In today’s fast-paced retail industry, having an efficient and effective point of sale (POS) system is crucial for success. Integrated POS systems have emerged as a game-changer for retail businesses, offering a comprehensive solution that combines sales, inventory management, customer data, and more. In this detailed guide, we will explore what integrated POS systems are, their components, benefits, key features to look for, how to choose the right system, implementation steps, common challenges, and frequently asked questions. By the end of this article, you will have a clear understanding of integrated POS systems and their importance in the retail sector.

What is an Integrated POS System?

An integrated POS system is a software solution that combines various aspects of retail operations into a single platform. It seamlessly integrates sales, inventory management, customer relationship management (CRM), accounting, and other essential functions. Unlike traditional POS systems that operate in isolation, integrated POS systems provide real-time data synchronization and streamline business processes. This integration enables retailers to have a holistic view of their operations, make informed decisions, and enhance the overall customer experience.

Understanding the Components of an Integrated POS System

To fully grasp the concept of integrated POS systems, it is essential to understand their key components. These components work together to create a unified system that optimizes retail operations. The main components of an integrated POS system include:

- Point of Sale (POS) Terminal: This is the hardware component of the system, typically consisting of a computer or tablet, barcode scanner, cash drawer, and receipt printer. The POS terminal is where sales transactions are processed.

- Inventory Management: Integrated POS systems have robust inventory management capabilities. They track stock levels, generate purchase orders, manage supplier relationships, and provide real-time visibility into inventory across multiple locations.

- Customer Relationship Management (CRM): CRM functionality allows retailers to capture and analyze customer data, including purchase history, preferences, and contact information. This data can be used to personalize marketing campaigns, improve customer service, and drive customer loyalty.

- Reporting and Analytics: Integrated POS systems offer advanced reporting and analytics tools that provide insights into sales performance, inventory turnover, customer behavior, and more. These reports help retailers identify trends, optimize pricing strategies, and make data-driven decisions.

- E-commerce Integration: Many integrated POS systems offer seamless integration with e-commerce platforms, allowing retailers to manage both online and offline sales from a single system. This integration ensures accurate inventory synchronization and provides a unified shopping experience for customers.

Benefits of Using an Integrated POS System for Retail Businesses

An integrated Point of Sale (POS) system offers numerous benefits for retail businesses, enhancing both operational efficiency and customer satisfaction. These systems go beyond mere transaction processing, integrating various business functions into a cohesive whole. Here’s a look at some of the key benefits that an integrated POS system can provide to a retail business:

1. Streamlined Operations

An integrated POS system centralizes numerous business processes, from sales and inventory management to customer relations and financial reporting. By having all these processes interlinked, the system reduces the need for manual data entry and minimizes errors. This integration ensures that information flows smoothly between different business areas, enabling faster response times and more accurate data handling.

2. Improved Inventory Management

One of the biggest advantages of an integrated POS system is its ability to manage inventory effectively. It updates stock levels in real-time as sales are made, providing accurate inventory data at any given moment. This capability allows retailers to optimize their stock levels, reducing the risk of overstocking or stockouts. Additionally, it can automatically reorder products that are running low, ensuring that popular items are always available.

3. Enhanced Customer Experience

Integrated POS systems often come with CRM (Customer Relationship Management) capabilities, which help businesses understand and manage their customer interactions more effectively. By tracking customer purchases and preferences, retailers can tailor their marketing efforts to individual needs and preferences. This personalized approach not only improves customer satisfaction but also increases loyalty and repeat business.

4. Efficient Employee Management

These systems can also integrate employee management tools that help track employee performance, manage schedules, and monitor sales targets. This integration makes it easier for managers to assess staff performance and provide necessary training or incentives. Furthermore, with an integrated system, employees can spend less time on administrative tasks and more time assisting customers, thereby enhancing the overall service quality.

5. Better Financial Accuracy

An integrated POS system automates the financial reporting process, reducing the chances of human error. It ensures that every transaction is accurately recorded and reconciled, providing reliable financial data. This accuracy is crucial for making informed business decisions and for simplifying the accounting process, especially during tax season.

6. Increased Sales Through Multiple Channels

Modern integrated POS systems support omnichannel retailing, meaning they can handle sales across different platforms — whether in-store, online, or via mobile. This flexibility allows businesses to reach customers wherever they are, increasing sales opportunities and providing a seamless shopping experience across all channels.

7. Enhanced Security

With advanced encryption technologies and compliance with payment card industry (PCI) standards, integrated POS systems provide robust security that protects sensitive data. This security is vital in maintaining customer trust, especially in an era where data breaches are increasingly common.

8. Scalability

As businesses grow, their systems need to adapt to new challenges and higher volumes of transactions. Integrated POS systems are scalable, meaning they can grow with the business. Adding new features, terminals, or integrating with other software becomes simpler with a system that is designed to accommodate growth.

Key Features to Look for in an Integrated POS System

When selecting an integrated Point of Sale (POS) system for your business, it’s crucial to consider features that can enhance efficiency, improve customer experience, and provide valuable insights into your operations. Here’s a guide to the key features you should look for in an integrated POS system:

1. Comprehensive Inventory Management

A top-tier POS system should offer robust inventory management capabilities. This feature should enable real-time tracking of stock levels, automate reordering, and provide alerts for low inventory. An advanced system will also support inventory categorization, facilitate easy stock adjustments, and generate detailed inventory reports to aid in forecasting and planning.

2. Multi-Channel Sales Integration

In today’s retail environment, the ability to sell across multiple channels — in-store, online, and through mobile apps — is essential. A good POS system should integrate seamlessly with various sales channels to ensure a consistent and efficient customer experience. This integration should also enable unified management of sales data, helping businesses understand customer behaviors across all platforms.

3. Customer Relationship Management (CRM)

Integrated CRM functionalities can significantly enhance customer interactions. Look for a POS system that records customer purchase histories and preferences to tailor marketing and sales strategies. Features like loyalty programs, personalized discounts, and targeted promotions can help increase customer retention and satisfaction.

4. Employee Management

Efficient management of staff schedules, performance, and access rights are important features in a POS system. Systems that include tools for clocking in and out, managing pay rates, and tracking sales by employee can improve accountability and productivity, while also simplifying payroll processing.

5. Flexible Payment Options

A versatile POS system should support a variety of payment methods including credit and debit cards, mobile payments, online payments, and even emerging options like cryptocurrencies. The system should also handle returns and exchanges smoothly, providing a hassle-free experience for both customers and staff.

6. Robust Reporting and Analytics

Data is a critical asset in managing and growing a business. Look for a POS system that offers comprehensive reporting and analytics tools. It should be able to generate sales reports, performance analyses, and other actionable insights that can inform business decisions. Customization options to tailor reports to specific business needs are an added advantage.

7. Ease of Use and User Interface

The user interface of your POS system should be intuitive and easy to use. This reduces training time and helps prevent errors during transactions. A system that can be easily navigated improves the efficiency of daily operations and enhances the overall user experience for both staff and customers.

8. Hardware Compatibility and Integration

Ensure that the POS system can integrate smoothly with existing hardware or that it provides options to purchase compatible hardware like scanners, printers, and cash drawers. Compatibility issues can lead to additional costs and disruptions in service.

9. Security Features

Given the sensitivity of transaction data, a secure POS system is non-negotiable. Look for systems that comply with the latest security standards, including PCI DSS compliance, data encryption, and user authentication protocols. Regular security updates and support from the provider are also crucial to protect against emerging threats.

10. Scalability and Customization

A POS system should grow with your business. Scalability in terms of adding new locations, products, or services, as well as the ability to customize features to fit specific business needs, are important. The system should offer the flexibility to add modules or integrations as your business evolves.

How to Choose the Right Integrated POS System for Your Retail Business

Choosing the right integrated Point of Sale (POS) system for your retail business is a critical decision that can impact your operations, customer service, and overall profitability. Here’s a structured approach to selecting a POS system that aligns with your business needs:

1. Assess Your Business Needs

Begin by evaluating the specific needs of your business. Consider the size of your business, the number of locations, the types of products you sell, and your sales volume. Also, think about the specific challenges you face, such as inventory management, customer relationship management, or multi-channel sales integration. Understanding these requirements will help you identify the features most crucial to your operations.

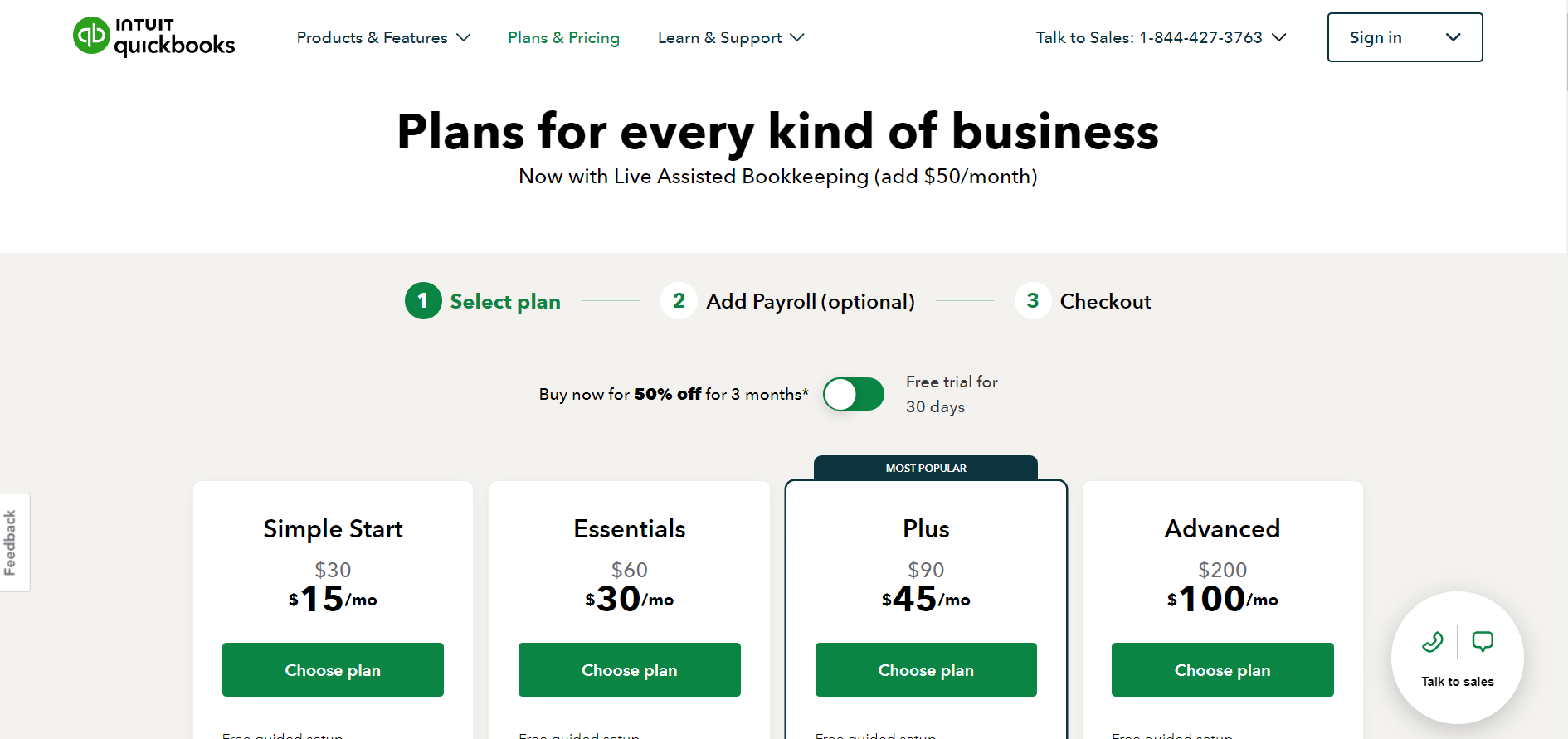

2. Set Your Budget

Determine how much you are willing to invest in a POS system. Costs can vary widely based on the features, hardware requirements, and scalability of the system. Consider not only the upfront costs but also ongoing expenses such as subscription fees, maintenance, and upgrades. A clear budget will help you narrow down your options to systems that are financially feasible.

3. Consider Usability and Training Requirements

The ease of use of a POS system is crucial, as it affects the speed of transactions and the training time required for your staff. Opt for a system with an intuitive user interface and simple navigation. It’s also important to consider the vendor’s training support and customer service, as these can significantly influence the implementation process and daily operations.

4. Evaluate Hardware Requirements

Some POS systems require specific hardware to operate, while others are compatible with existing hardware or are entirely cloud-based. Assess your current hardware and determine whether you need to purchase new equipment. Factor in the space available for installing such hardware, especially if your retail environment has limited counter space.

5. Explore Integration Capabilities

An ideal POS system should seamlessly integrate with other tools and platforms you use, such as accounting software, e-commerce platforms, and customer loyalty programs. Integration capability can prevent data silos and streamline your operations, making your business more efficient and reducing the likelihood of errors.

6. Investigate Payment Processing Options

Your POS system should support a wide range of payment methods, including credit cards, debit cards, mobile payments, and possibly even cryptocurrencies. Look for systems that offer secure payment solutions and comply with payment industry standards to protect your business and customers from fraud.

7. Check for Scalability

The POS system you choose should be able to grow with your business. Consider whether the system can handle increased transaction volumes, new product lines, or additional store locations. Scalability is crucial to avoid the need for a system overhaul as your business expands.

8. Read Reviews and Request Demos

Once you have a shortlist of potential POS systems, read customer reviews to gauge the experiences of other businesses similar to yours. Additionally, request demos from vendors to see the system in action. This can help you understand the functionality and usability of the system and determine if it meets your expectations.

9. Consider Security Features

Security is paramount when handling transaction data and customer information. Ensure that the POS system adheres to the latest security standards and offers features like data encryption, secure login procedures, and regular security updates.

Implementing an Integrated POS System: Step-by-Step Guide

Implementing an integrated POS system requires careful planning and execution. Here is a step-by-step guide to help you through the process:

- Define Your Objectives: Clearly define your objectives for implementing the integrated POS system. Identify the specific goals you want to achieve, such as improving inventory accuracy, increasing sales, or enhancing customer satisfaction.

- Prepare Your Data: Cleanse and organize your existing data to ensure its accuracy and consistency. This includes customer data, product information, pricing, and inventory levels. Consider hiring a data specialist if needed.

- Hardware and Software Setup: Install the necessary hardware components, such as POS terminals, barcode scanners, and receipt printers. Set up the integrated POS software and configure it according to your business requirements.

- Data Migration: If you are transitioning from an existing POS system, migrate your data to the new system. Ensure that all customer data, product information, and inventory levels are accurately transferred.

- Employee Training: Provide comprehensive training to your employees on how to use the integrated POS system. Cover topics like processing sales transactions, managing inventory, accessing customer data, and generating reports.

- Test and Fine-tune: Conduct thorough testing of the integrated POS system to ensure its functionality and compatibility with your business processes. Fine-tune the system based on feedback from employees and make any necessary adjustments.

- Go Live: Once you are confident in the system’s performance, go live with the integrated POS system. Monitor its operation closely during the initial days and address any issues or concerns promptly.

- Ongoing Support and Maintenance: Establish a support system with the POS system provider to address any technical issues or questions that may arise. Regularly update the software and hardware components to ensure optimal performance.

Common Challenges and Solutions in Implementing an Integrated POS System

Implementing an integrated POS system can come with its fair share of challenges. Here are some common challenges and their solutions:

- Resistance to Change: Employees may resist the adoption of a new POS system due to fear of the unknown or a steep learning curve. To overcome this, provide comprehensive training, involve employees in the decision-making process, and highlight the benefits of the new system.

- Data Migration Issues: Data migration from an existing POS system can be complex and prone to errors. To mitigate this, thoroughly clean and organize your data before migration, conduct extensive testing, and have a backup plan in case of any issues.

- Integration Challenges: Integrating the POS system with other business software can be challenging, especially if the systems have different data formats or APIs. Work closely with the POS system provider and other software vendors to ensure seamless integration.

- Technical Issues: Technical issues like system crashes, slow performance, or connectivity problems can disrupt operations. Establish a support system with the POS system provider and have a dedicated IT team to address technical issues promptly.

- Employee Training: Training employees on how to use the new POS system effectively can be time-consuming and resource-intensive. Develop a comprehensive training plan, provide ongoing support, and consider appointing super-users who can assist their colleagues.

Frequently Asked Questions

Q.1: What is the cost of implementing an integrated POS system?

Answer: The cost of implementing an integrated POS system varies depending on factors like the size of your business, number of store locations, desired features, and hardware requirements. It typically includes upfront costs for hardware, software licensing fees, and ongoing support costs. It is advisable to request quotes from multiple POS system providers and compare their pricing structures.

Q.2: Can an integrated POS system handle multiple store locations?

Answer: Yes, most integrated POS systems are designed to handle multiple store locations. They provide centralized control and real-time data synchronization across all locations, allowing retailers to manage inventory, sales, and customer data seamlessly.

Q.3: How secure are integrated POS systems in terms of data protection?

Answer: Integrated POS systems prioritize data security and employ various measures to protect sensitive information. These measures include encryption of data in transit and at rest, user access controls, secure payment processing, and compliance with industry standards like PCI-DSS. It is important to choose a reputable POS system provider that prioritizes data security.

Q.4: Can an integrated POS system integrate with other business software?

Answer: Yes, most integrated POS systems offer integration capabilities with other business software, such as accounting, e-commerce, and CRM platforms. This integration ensures seamless data flow between systems, eliminates manual data entry, and improves overall efficiency.

Q.5: What kind of training is required for employees to use an integrated POS system?

Answer: The training required for employees to use an integrated POS system depends on the complexity of the system and the employees’ familiarity with technology. It typically includes training on basic functions like processing sales transactions, managing inventory, accessing customer data, and generating reports. The POS system provider should offer comprehensive training materials and ongoing support to ensure a smooth transition.

Conclusion

Integrated POS systems have revolutionized the retail industry by providing a comprehensive solution that combines sales, inventory management, customer data, and more. These systems streamline operations, enhance the customer experience, and provide valuable insights for data-driven decision-making. By understanding the components, benefits, key features, and implementation steps of integrated POS systems, retail businesses can make informed choices and stay ahead in the competitive market. Embracing integrated POS systems is the future of retail, enabling businesses to thrive in the digital age.