In the evolving landscape of digital payments, both contactless payments and mobile wallets have emerged as convenient and secure alternatives to traditional payment methods. Although often used interchangeably, these two payment technologies are distinct in terms of how they function and the specific tools they use to facilitate transactions. As businesses and consumers increasingly adopt these technologies, understanding the differences between contactless payments and mobile wallets is crucial.

This article will provide a comprehensive comparison between contactless payments and mobile wallets, explaining how each technology works, their advantages and disadvantages, their security features, and how businesses and consumers can best utilize these payment methods.

What Are Contactless Payments?

Contactless payments refer to transactions that are completed by tapping or waving a contactless-enabled card, key fob, smartphone, or wearable device near a point-of-sale (POS) terminal equipped with Near Field Communication (NFC) technology. Unlike traditional payment methods that require physical contact, such as swiping a card or inserting a chip, contactless payments allow for faster and more convenient transactions.

How Contactless Payments Work

Contactless payments rely on NFC technology to transmit payment information securely between the card or device and the payment terminal. Here’s how the process works:

- Initiation: The customer taps or waves their contactless-enabled card or device near the NFC-enabled POS terminal.

- Data Transmission: The terminal reads the encrypted payment information from the card or device and sends it to the payment processor.

- Authorization: The payment processor authorizes the transaction and communicates the approval back to the terminal.

- Completion: The payment is completed within seconds, and the transaction receipt is generated for the customer.

Types of Contactless Payments

- Contactless Credit/Debit Cards: These cards come with an embedded NFC chip that allows users to tap and pay without swiping or inserting the card into the terminal.

- Wearable Devices: Devices such as smartwatches, fitness trackers, and key fobs with NFC functionality can be used for contactless payments.

- Smartphones: Many smartphones now come equipped with NFC technology, enabling them to make contactless payments via apps or mobile wallets.

Advantages of Contactless Payments

- Speed and Convenience: Contactless payments are quick and easy, allowing customers to complete transactions in a fraction of the time required for chip-and-PIN or swipe payments.

- Hygienic and Contact-Free: Since customers do not need to physically touch the terminal or hand over their card, contactless payments offer a hygienic, touch-free experience.

- Widely Accepted: Contactless payment technology is widely adopted by most major retailers, making it a convenient option for customers in various settings.

Disadvantages of Contactless Payments

- Transaction Limits: In some countries, contactless payments are limited to a certain transaction amount (typically $50 to $100), which can be a barrier for larger purchases.

- Card Fraud Risks: While contactless payments are generally secure, lost or stolen cards can be used for small transactions without requiring a PIN or signature.

- Limited Availability in Some Regions: Not all regions have fully adopted contactless technology, limiting its accessibility for some consumers.

What Are Mobile Wallets?

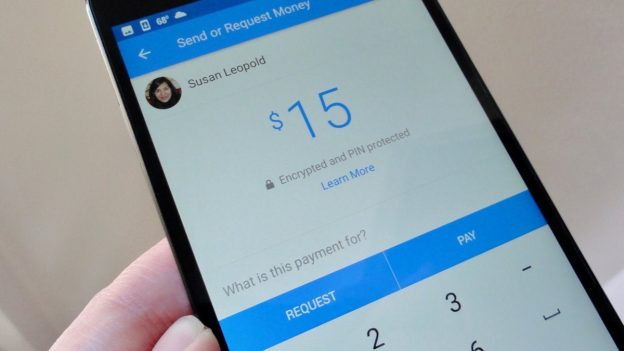

Mobile wallets, also known as digital wallets, are smartphone apps or platforms that store a user’s credit card, debit card, and other payment information in digital form. These apps allow users to make payments, send money, and manage their finances directly from their smartphones. Mobile wallets can facilitate contactless payments, but they offer additional features beyond simple tap-and-pay functionality.

How Mobile Wallets Work

Mobile wallets store encrypted payment information in a secure environment on a smartphone. When making a purchase, the wallet generates a unique, one-time token that is transmitted to the POS terminal via NFC. This tokenization process ensures that sensitive payment details are never shared with the merchant. Here’s how mobile wallets work:

- Account Setup: The user downloads a mobile wallet app (such as Apple Pay, Google Pay, or Samsung Pay) and links their payment cards to the app by scanning or manually entering card details.

- Initiation: To make a payment, the user unlocks their phone, opens the wallet app, and taps their smartphone near an NFC-enabled POS terminal.

- Transaction Tokenization: The mobile wallet generates a token (a temporary substitute for the actual card number) and sends it to the payment terminal via NFC.

- Payment Authorization: The token is processed by the payment processor, and the transaction is authorized without exposing sensitive card details.

- Completion: The transaction is completed within seconds, and the customer receives a digital receipt.

Popular Mobile Wallets

- Apple Pay: A widely used mobile wallet for iPhone and Apple Watch users that supports contactless payments, online purchases, and peer-to-peer transfers.

- Google Pay: Available on Android devices, Google Pay supports contactless payments, in-app purchases, and peer-to-peer money transfers.

- Samsung Pay: Samsung Pay works on Samsung devices and offers a broader range of payment options, including compatibility with both NFC and Magnetic Secure Transmission (MST) technology for legacy payment terminals.

Advantages of Mobile Wallets

- Enhanced Security: Mobile wallets use tokenization and biometric authentication (such as fingerprint or facial recognition) to secure transactions, making them highly secure.

- Versatility: In addition to contactless payments, mobile wallets can be used for online purchases, storing loyalty cards, and even managing cryptocurrency.

- Increased Convenience: Users can store multiple cards, access transaction histories, and manage their finances directly from their smartphone.

- Loyalty and Rewards Integration: Many mobile wallets offer integration with loyalty programs, allowing users to automatically earn rewards or discounts when making purchases.

Disadvantages of Mobile Wallets

- Dependence on Smartphone: Users must have their smartphone (with battery life) available to make payments, which can be inconvenient in certain situations.

- Limited Merchant Acceptance: While acceptance of mobile wallets is growing, not all merchants have upgraded their POS systems to support NFC payments, limiting the use of mobile wallets in some locations.

- Data Privacy Concerns: Since mobile wallets store and manage sensitive financial information, concerns about data breaches and privacy persist among some users.

Differences Between Contactless Payments and Mobile Wallets

The table below summarizes the key differences between contactless payments and mobile wallets:

| Feature | Contactless Payments | Mobile Wallets |

|---|---|---|

| Technology | Uses NFC-enabled cards or devices | Uses NFC, tokenization, and biometric authentication |

| Setup | No setup required, uses existing contactless cards | Requires app download and linking of payment cards |

| Security | Encrypted but lacks additional layers like biometrics | More secure with tokenization and biometric authentication |

| Transaction Limits | Often has limits for small purchases | Typically no limits or higher limits for transactions |

| Versatility | Primarily for in-person transactions | Used for in-store, online, in-app payments, and P2P transfers |

| Dependency on Devices | Contactless cards or wearables | Requires a smartphone or wearable device |

| Adoption | Widespread adoption among merchants | Growing, but some smaller merchants may not support it |

| Loyalty and Rewards | Rarely supports loyalty programs directly | Often integrated with loyalty programs and gift cards |

| Fraud Prevention | Risk if card is lost or stolen | Low risk due to biometric authentication and tokenization |

FAQs

Q1: Are contactless payments more secure than mobile wallets?

Mobile wallets are generally considered more secure than contactless cards due to the use of tokenization and biometric authentication. However, both methods offer robust security features, and contactless cards are still a safe option for most transactions.

Q2: Do mobile wallets work for online shopping?

Yes, mobile wallets like Apple Pay and Google Pay can be used for online shopping, providing

the convenience of fast, secure payments without having to manually enter card details. This makes mobile wallets more versatile than contactless cards, which are primarily designed for in-person transactions.

Q3: What’s the difference between NFC and MST technology?

NFC (Near Field Communication) allows two devices to communicate when they are close to each other (within 4 centimeters), making it the standard for contactless payments. MST (Magnetic Secure Transmission), used by Samsung Pay, simulates the magnetic stripe of a traditional card, allowing it to work on older payment terminals that do not support NFC. This makes Samsung Pay compatible with more merchants than other mobile wallets.

Q4: Are contactless payments limited by transaction amounts?

Yes, contactless card payments often have transaction limits imposed by banks and payment networks, typically around $50 to $100, depending on the country and bank policies. Mobile wallets, however, tend to have higher transaction limits or none at all, depending on the merchant’s setup and the payment processor.

Q5: Can I use both contactless payments and mobile wallets at the same merchant?

In most cases, yes. Many merchants that accept contactless card payments also support mobile wallets. If the point-of-sale terminal is equipped with NFC technology, it can usually handle both forms of payment.

Q6: What are the advantages of using a mobile wallet over a contactless card?

Mobile wallets offer additional security features such as biometric authentication and tokenization, which provide enhanced protection against fraud. They also offer greater versatility by supporting online shopping, loyalty card storage, and peer-to-peer transfers, making them more comprehensive than contactless cards.

Q7: Can mobile wallets be used internationally?

Yes, mobile wallets like Apple Pay, Google Pay, and Samsung Pay can be used internationally wherever NFC-enabled terminals are available, provided the user’s bank supports international transactions. However, users should be aware of potential foreign transaction fees imposed by their card issuer.

Q8: Do mobile wallets support loyalty programs?

Yes, many mobile wallets offer the ability to store loyalty cards and automatically apply discounts or rewards when making a purchase. This integration can simplify the shopping experience by consolidating payment methods and rewards programs into a single app.

Conclusion

Both contactless payments and mobile wallets offer fast, convenient, and secure ways to complete transactions, but there are important distinctions between the two. Contactless payments using NFC-enabled cards are simple and widely accepted, making them an ideal option for quick, low-value purchases. On the other hand, mobile wallets provide greater versatility, advanced security, and additional features like loyalty program integration and peer-to-peer transfers.

As technology continues to evolve, it’s becoming increasingly important for businesses and consumers alike to embrace these payment methods. For businesses, offering both contactless payments and mobile wallet support can improve customer satisfaction and reduce transaction times. For consumers, understanding the differences between these options can help them choose the most convenient and secure payment method for their needs.

In the future, as the adoption of digital wallets and contactless payments continues to grow, businesses that integrate these technologies into their payment systems will likely have a competitive edge. Whether you’re using a contactless card for a quick tap-and-go transaction or managing multiple payment methods and loyalty cards in a mobile wallet, these technologies are shaping the future of commerce.