By alphacardprocess December 31, 2021

Facebook has found a way to increase user engagement and time spent on their website by introducing Facebook Pay. Facebook users are able to send money in Messenger using debit cards or PayPal, however Facebook is now offering an in-app quick payment system that allows for instant transfer of funds between friends through the use of the credit/debit card information already saved to their profile.

Facebook Pay is currently available in the USA and India, with more countries planned over the coming months. Facebook plans on charging users for this service; it will keep 3% of all payments made through Facebook Pay. This information comes from a source familiar with the matter.

The main competitors to Facebook Pay are Snapchat’s Snapcash, Apple Pay, and Google Wallet.

Facebook is considered (who? by whom?) to be the biggest social network in the world; according to recent statistics, Facebook has more than 1.65 billion monthly active users worldwide. It is estimated that around 46 million American adults use messenger apps on their smart phones every month .

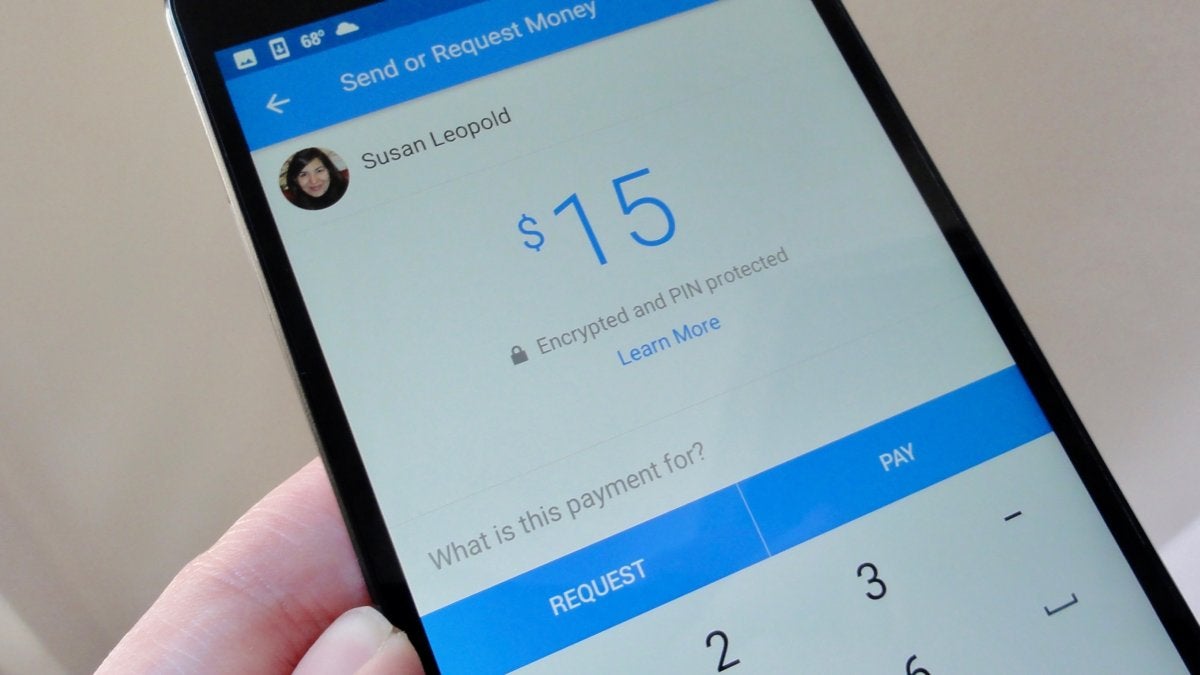

The premise of Facebook Pay is to allow for easy payment within the Messenger app. Users are able to send money in an instant, without exchanging bank or financial details with friends or family. Instead, they just need their debit card information on file that is saved when they first create their account. Additionally, users can select PayPal as a payment option.

Facebook Pay is only available for individuals aged 18 and over. Parents are also able to use this service if their child has authorized them as an access account holder. They are not allowed to make payments on behalf of the user, but can settle any disputes should money be sent without agreement. Users will receive a notification when someone makes a payment on their behalf.

This function makes it easier for the new generation that grew up with social media to keep in touch with friends and family, while also making payments!

Facebook has a strong understanding of data; by using pre-existing information like names, passwords, birthdays, phone numbers (for authentication), they are able to offer this service in a way that will appeal to their target audience. Over 1.5 billion people use Facebook every month; if only a small portion of the users (less than 5%) decide to use this service, there will be huge gains for the company!

If you’ve ever tried using Snapchat’s Snapcash feature, you’ll notice similarities with Facebook Pay, in the sense that it is instant, and once you send money to someone, they cannot refund or reverse this action. Users are also required to double check their payment amount before sending!

Facebook does not allow users to request money from friends; only payments can be made. Before you send money through Facebook Pay, both parties must agree that the payment is to be made. It will take the money from your account, but you will not receive any confirmation until the transaction has been approved by your friend.

Users are unable to make multiple payments in quick succession; they must wait 60 minutes between each payment (or update) request.

As with most social media websites nowadays, people are wondering how much personal information Facebook will have access to. According to their terms and conditions, they claim that all information sent by you through this service will remain confidential. This is a bold statement, but we’ll just have to wait and see if it changes in the future.

Facebook has been known for making controversial decisions in the past; it remains to be seen if an issue will arise in the future.

Facebook has announced that they plan on charging users a fee for using this service (3%). This information comes from a source familiar with the matter, and was also announced in their official press release.