QuickBooks Desktop POS has been a trusted companion for years, efficiently managing business transactions. It has been the cornerstone of operations for many businesses, streamlining payment processing, report generation, and inventory tracking.

But now, QuickBooks Point of Sale is discontinued, and it’s time to bid farewell to QuickBooks Desktop POS. Intuit, the creator of this reliable software, introduced QuickBooks Desktop POS over two decades ago, assisting retailers in enhancing their store management. Intuit made the decision to discontinue the POS in the previous month (October 3, 2023). Furthermore, there won’t be any forthcoming versions of QuickBooks Desktop POS software, and new customers will no longer have access to these solutions.

The discontinuation of POS Desktop necessitates finding alternative solutions for payment processing and POS requirements. Don’t worry; we will help you with this. But before moving forward, it is essential to know why it was discontinued.

QuickBooks Point of Sale is Discontinued – What Is The Reason?

Image source

QuickBooks POS was a versatile retail point-of-sale system tailored to various small and medium-sized enterprises, including clothing and shoe stores, small franchises, sporting goods shops, and gift boutiques. It featured essential inventory and customer management tools, merchandise planning, and compatibility with tablet-based point-of-sale systems. It was available in both cloud-based and on-premise deployment options.

QuickBooks POS offered fundamental functionalities such as payment processing and returns and robust inventory management capabilities. Users could effortlessly monitor their inventory, receive alerts when items were running low, and efficiently place orders to replenish stock. The system also stored valuable customer data, facilitating the tracking of purchase history and buying patterns.

However, QuickBooks Point of Sale was Discontinued because the distinct platform on which QuickBooks POS was built necessitated intricate maintenance and posed challenges for introducing new features. This complexity stands as the primary reason for its discontinuation, and it was the only reason stated by the company behind the reason for halting it.

Can You Use The POS Systems Now Even After It Is Discontinued?

You have the option to keep using your QuickBooks POS for as long as you prefer. However, there are several crucial considerations to bear in mind. After being discontinued, the QuickBooks Desktop POS software has stopped all the associated services. These services that were stopped include:

- Online Backup

- Online Banking

- QuickBooks POS services for the Gift Card

- Payment Security Updates

- Mobile Synchronization

- Store Exchange – Multi-Store Connectivity

- Connected Services

- E-commerce integration with Webgility

- Support plans, including Live Support (email and chat)

- Additional user licenses

- Vendor Lookup Service

- Security updates

- Payroll Services

While it is technically feasible to continue using QuickBooks POS without these services, it is crucial to acknowledge the potential risks. The absence of support, including critical security patches, could render your system progressively susceptible to cyberattacks and data breaches.

What Should Be Your Next Step As This POS’s Customer?

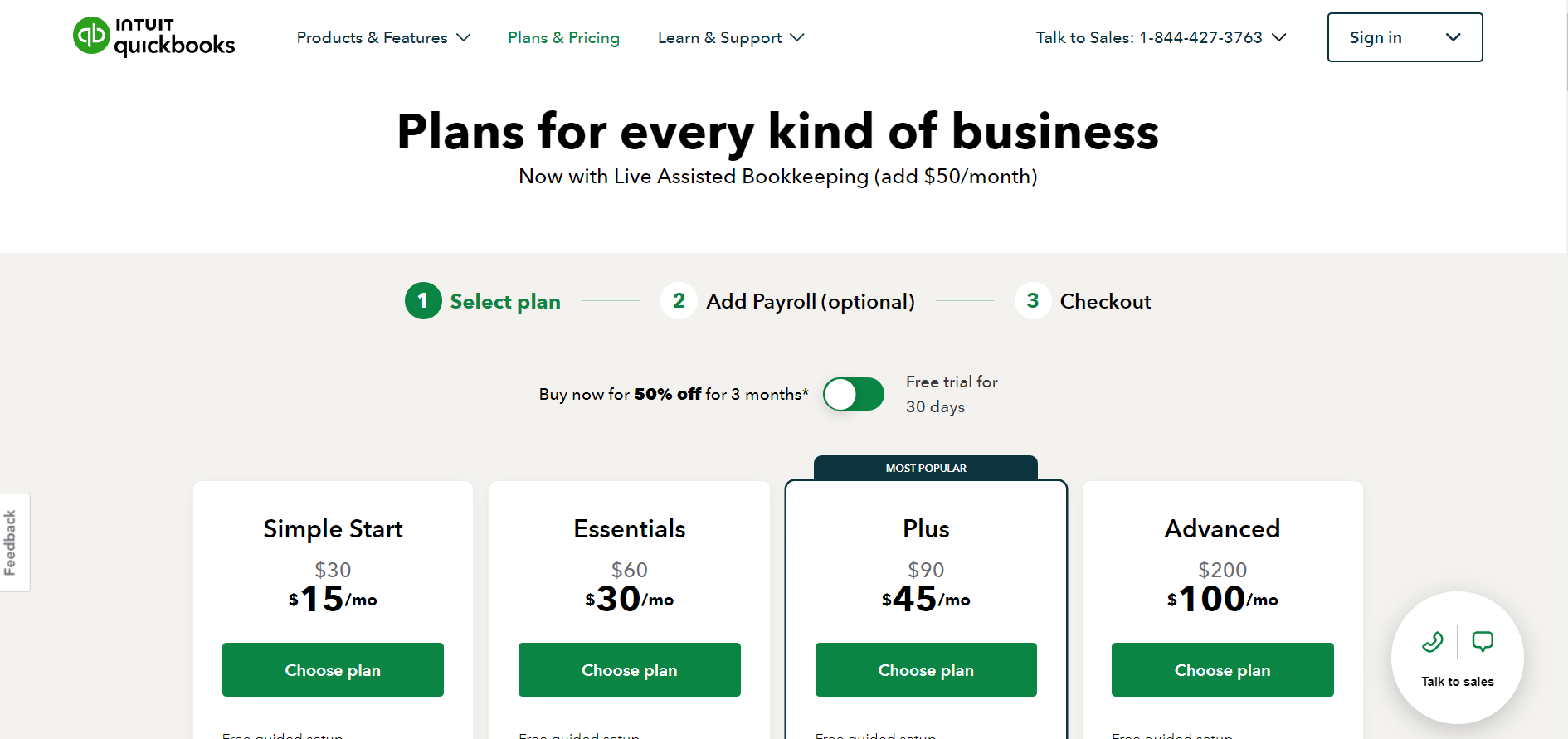

After QuickBooks POS was Discontinued, customers now need to plan their transition to a new POS tool. QuickBooks has established a partnership with the e-commerce platform Shopify to provide a POS solution that seamlessly integrates with QuickBooks Desktop Financial Software. However, Intuit also encourages customers to explore various POS solutions to identify the one that best suits their business.

If you are in search of a suitable QuickBooks POS replacement, you have several options:

- Migrate to Shopify.

- Consider a different industry-neutral POS program.

- Explore an industry-specific POS system tailored to meet the unique needs of your business.

But, it’s advisable to select a POS system designed for businesses within your specific industry or niche. You should choose wisely to avoid this kind of situation.

While many POS solutions are in the market right now, it’s essential to consider whether they align with your business requirements. Opting for a good and reputed company is the solution, as small impersonal companies may not always guarantee the support you need in the long run. Some providers rely heavily on self-service customer support and offer one-size-fits-all solutions.

So, in the further sections, we will first discuss how you can migrate from QuickBooks to Shopify for an easy and fast approach. But if you are looking for some other alternatives, we will also discuss those by the end.

Migrating QuickBooks POS to Shopify POS

If you want a fast solution to migrate from QuickBooks to directly Shopify, here is how you can do it:

Step 1: Exporting The Data

To transition from QB POS to Shopify POS, you can begin by exporting various data types, such as Inventory Items, Vendors, Customers, Employees, and Departments, to Excel. Follow these steps:

- Launch the QuickBooks POS.

- Navigate to “File”> then click on “Utilities”> and then click the Export option.

- Choose the specific data type you wish to export, like Items or Customers. For example, let’s select “Customers.” In the DataExport Wizard, follow these instructions for exporting Customer data:

- Select the file where the exported data will be saved.

- Then, write all the records to the worksheet where the data should be placed.

- Begin exporting for data placement.

- In the “Export Template” section, you can opt for a default template for exporting data from the QuickBooks POS.

- Then Click Next to proceed.

- Verify that the data marked is correct.

- Finally, select Export.

All the data is now successfully added to your computer. Repeat this process again to export other data, such as Inventory Items, Vendors, Departments, and Employees. This comprehensive data export sets the stage for a smooth migration to Shopify POS.

Step 2: Sign Up for a Shopify Store

Migrating from QuickBooks Point of Sale to Shopify Point of Sale involves creating a Shopify account. Follow these steps to get started:

- Go to the Shopify’s official website at Shopify.com.

- Navigate to and click on the “Get Started” button to initiate the sign-up process.

- In the next window, you’ll be asked your email to access the exclusive discounts and other migration tools designed specifically for QuickBooks POS merchants. And after filling in the details, click on “Next.”

- Now, you will be asked to create your new Shopify account. Begin by selecting your location and then click “Next.”

- Select your preferred sign-up option, whether it’s via Email, Google, or another option, to create the ID for Shopify.

- Provide your email address and enter a strong password for your Shopify account.

- Click to Create a new Shopify ID.

The system will take time to verify the account and set up the Shopify store. After the process is complete, your free trial version will be activated.

Step 3: Get the Migration Tool for Shopify

To facilitate the seamless transfer of data from your QuickBooks to Shopify, you’ll need to download the QuickBooks Desktop POS Migration Tool. Follow these steps to install the tool:

- Navigate to “Home” within your Shopify store.

- Find the migration guide of QuickBooks and click on “Import Products.”

- Then Select “Launch connector” and Click “Install.”

- Then, click on “Install App.”

- Lastly, click on “Get Started” and begin the process of migrating data from QuickBooks POS to Shopify’s POS.

- Click “Allow” to grant the necessary permissions.

With these steps completed, you’re on your way to streamlining your transition to your Shopify POS.

Step 4: Importing All the Data Files to Shopify

Now, it’s time to transfer that data into your Shopify POS. Follow these steps to start the importing process:

- Click on the Add the data files option you wish to import, such as Customers, Vendors, or Inventory.

- Browse your computer to locate the folder where you previously exported your company’s POS data. Then, upload these files to your Shopify account.

- Select the QuickBooks POS items you want to import and click “Open.”

- After the data is uploaded, you’ll need to type in Stocky API to initiate the migration.

Step 5: Completing the Process

Stocky, Shopify’s application for inventory management that is at zero cost for QuickBooks POS users. Here’s how you can get the Stocky API key: follow these steps:

- Continuing the fourth step, navigate and click on the Find the API key option.

- The following window will prompt you to type in your store’s domain.

- Click on “Install app.”

- Your account will begin to sync.

- After the sync is complete, click on “OK.”

- Go to the “Preferences” and then select “API access.”

- Then, Click on the button to Generate the API key.

- Copy the generated API and paste it into the Desktop Connector.

- Click on the “Next” option.

Step 6: Add the New Locations to Your Shopify Store

Now, all the files are successfully uploaded, and you can proceed to match your QuickBooks store locations with those in your Shopify store.

Here’s how to do it:

- On the ” Location matching option,” choose an existing location from your Shopify store.

- If you need a new location in Shopify, click “Add a new location.”

- With your locations matched and ready, click on “Start Migration.”

The migration process will start. The duration of this process may vary, taking a few hours based on the size of the data file.

Alternatives To QuickBooks And Shopify POS

If you are looking for other QuickBooks POS alternatives, there are plenty of options in the market. Here are some popular choices:

Square

Square POS is a cutting-edge cloud-based business management system designed to streamline your business operations with better features than QuickBooks. With this versatile solution, you can efficiently manage inventory, monitor sales, securely process payments, and more. It’s no wonder that millions of businesses rely on Square Point of Sale for their daily operations.

Key Features:

- The Square Point of Sale system is entirely virtual, offering compatibility with various software applications. And it can be accessed from any device.

- Getting started with Square POS is a breeze, as it offers a free entry point. There are no installation or setup costs, and you won’t encounter any monthly fees.

- Square Point of Sale takes your business a step further by offering an integrated online store free of charge. What’s more, businesses have the freedom to customize their online store to reflect their unique brand and product offerings.

- Square POS doesn’t operate in isolation; it seamlessly integrates with other Square small business tools. These integrations span various aspects, including employee management and the CRM.

Clover Network

Clover serves as a comprehensive solution for small businesses’ various customer checkout requirements. It has both POS hardware and software, credit card processing, virtual terminals, and online ordering capabilities. With Clover, you gain access to swift credit card and digital payment processing and a versatile system that facilitates online order acceptance, supports gift cards, provides inventory management, generates reports, and even aids in implementing loyalty programs.

Key Features:

- One distinct financial feature offered by Clover is Clover Rapid Deposit. This service expedites the transfer of funds from your card sales, reducing the standard waiting period from one or two days to mere minutes.

- Clover stands out as an all-in-one solution, presenting additional payment financing options that aren’t readily available with many of its competitors.

- Clover extends e-commerce tools to its customers, allowing them to construct websites, synchronize orders, and efficiently manage inventory and customer data.

- It offers a multifaceted approach to address the diverse demands of businesses, making it a valuable asset for modern enterprises.

Lavu

Lavu is a versatile POS solution tailor-made for the hospitality industry, serving a broad spectrum of businesses ranging from full-service restaurants, quick-service establishments, and franchise restaurants to food trucks, coffee shops, and nightlife venues like bars and lounges. The system provides users with a choice between specialized interfaces, namely bar, restaurant, and quick-service, each meticulously designed to cater to the specific needs of their respective environments.

Key Features:

- Suited for Freelancers, Small and Medium-sized Enterprises (SMEs), and Large Enterprises

- Compatible with iPad and iPhone

- Integration capabilities with popular platforms such as PayPal, Square POS, Marketman, and Paychex Flex.

Talech

Talech POS is a cloud-based point-of-sale system catering to diverse industries, including restaurants, retail establishments, and professional services businesses. Its remarkable repertoire of industry-specific features and flexible hardware options positions it as a compelling choice for many businesses seeking efficient POS solutions.

However, it’s worth noting that Square and Clover may hold a distinct allure for businesses seeking comprehensive, all-in-one solutions with their analogous monthly costs and proprietary hardware offerings.

Key Features:

- One of the standout attributes of Talech POS is its user-friendly interface and the extensive range of features it provides.

- It offers the advantage of not mandating a commitment to a specific credit card processing service.

- Talech POS is designed for ease of use, promising a seamless connection of all components, which it delivers with precision.

- This software is particularly well-suited for merchants and other small and medium-sized enterprises (SMEs), aligning with their specific operational requirements and growth objectives.

Conclusion

QuickBooks Point of Sale’s discontinuation marks the end of an era of efficient business management. Users should consider security risks and explore alternatives like Shopify, Square, Clover, Lavu, and Talech, tailored to specific business needs for a smooth transition.