By max September 15, 2023

Released in 1983, QuickBooks is a consumer-friendly software designed by Intuit to organize and automate tedious tasks. Operating as a cloud-based platform, QuickBooks Online can simplify your day-to-day operations. It basically helps you relax without having your business fall apart.

If you are running a small business with no interest in investing your time in learning complicated software to upgrade your company’s operations, QuickBooks Online is the answer for you. It will serve you with customized solutions developed for the sole purpose of managing your finances.

Now, you might assume that this accounting software of high-tech facilities would cost a fortune, which is not very appealing to most people. Luckily, according to QuickBooks pricing details, it offers a choice between multiple subscription plans based on your individual needs. This way, you won’t have to pay for anything that does not benefit your company. Availing of discounted deals before the purchase can also save you some money.

How Much Does QuickBooks Online Costs?

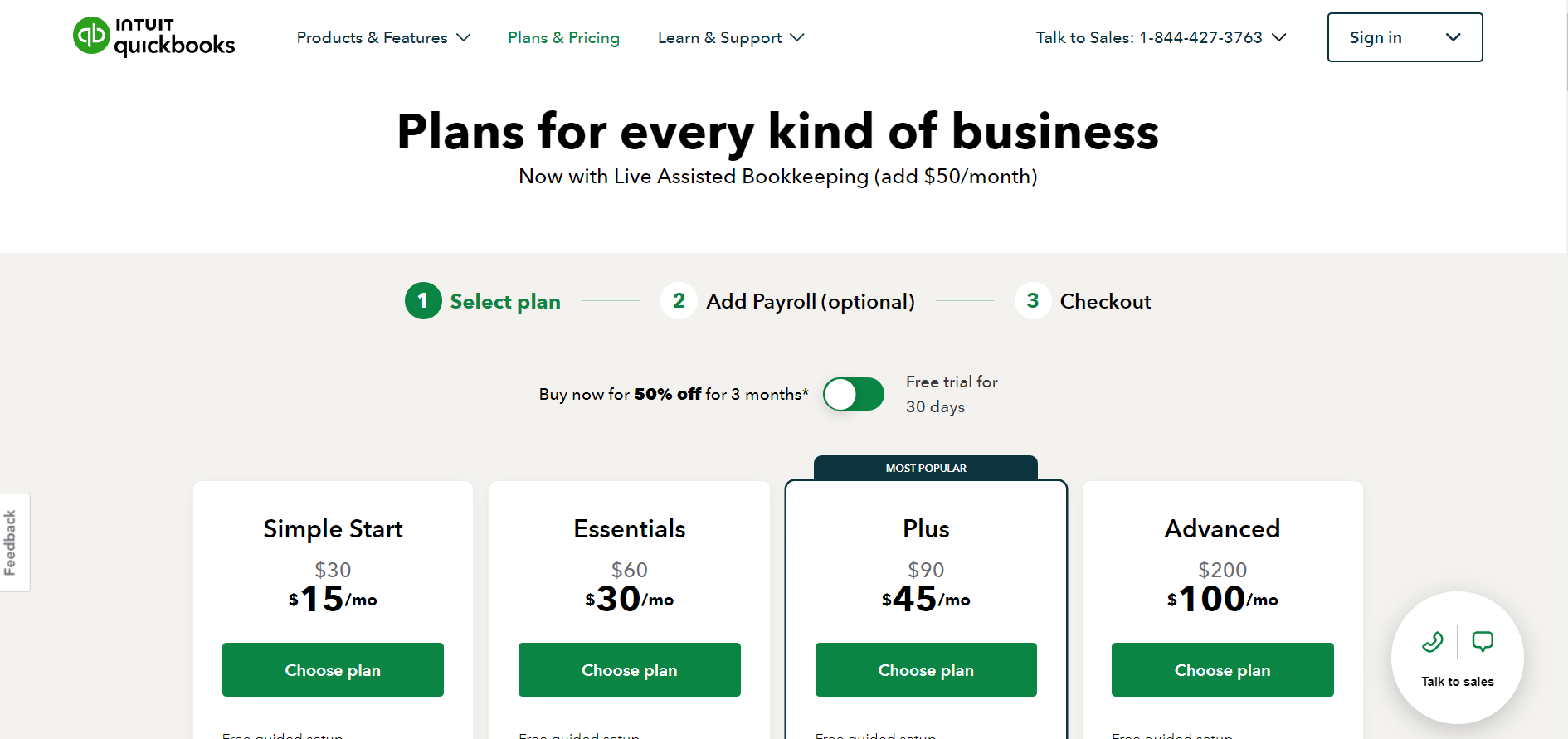

Image Source: QuickBooks Online

Even though no one can guarantee the exact amount, you can still figure out a quick estimate for a start. The total payable cost is an accumulation of several small charges which are not always clarified upfront. To help determine what works for you, we will point out the factors affecting the QuickBooks Online pricing.

QuickBooks Online Subscription Plans

Before you sign up for a long-term billing commitment, we would advise a survey of the subscription plans initiated by QuickBooks. This will disburden you from excessive features and ensure that you are only charged for what you utilize. These subscription plans include free access for the first 30 days. However, if you want to relish the 50% discount deal, you cannot avail of the free trial.

QuickBooks Simple Start

Simple Start is the most basic plan that offers single-user control and charges $30 per month without an annual deduction. With this plan, you (and your accountant) can send invoices, keep tabs on client’s payments, organize receipts, track GST, and access reports on your income and expenses. Although subscribing to the Simple Start plan won’t dramatically improve your business model overnight, you will significantly benefit from the live bank feeds, budget and cash flow forecasting, and bookkeeping functions.

Developing a client database will monitor overdue bills to update you on who has not paid yet. Doing that can help you avoid uncalled-for situations. Vehicle tracking can be used to review driving time and fuel updates.

One thing that needs to be considered is that this plan is recommended for small businesses requiring basic accounting with access to over 20 reports. They can connect to only one sales channel. The customer support options are primary. Users can avail the live chat and phone support. Email customer service and training through video tutorials are also covered.

QuickBooks Online Essentials

QuickBooks Online pricing for its Essentials subscription plan starts from a $60 monthly fee. Along with everything offered in the Simple Start plan, users subscribing to this plan can connect to over three online sales channels, access time tracking, scan and pay bills, and update unpaid bills. The perk is that up to 3 users can share the QuickBooks account and access over 40 reports.

The Essential Plan is suitable for fast-growing businesses and includes basic consumer support and recurring billing features. It initiates the possibility of tracking billable hours and editing them separately in the invoices for each client.

QuickBooks Online Plus

Offering advanced features to accommodate businesses that demand project management and inventory tracking, QuickBooks Online Plus costs $90 per month. It simultaneously allows access to 5 users and purveys job costing, budget management, and class tracking. Users can connect to all sales channels to increase efficiency and view illimitable live reports. Another note-worthy feature that you will need is tax support.

QuickBooks Online Plus is highly preferred among medium-scale businesses as it offers all the necessary functions within an affordable budget. You can view all projects in one place while tracking the detailed expenses of each task separately. Adding the ability to manage inventory and getting notified about stock availability makes it the most recommended pricing plan.

After importing the data from Excel, you can easily sync it with any shopping platform. You can share the desired product information on notable online marketplaces such as Amazon and Shopify instantly without taking any tedious steps.

QuickBooks Online Advanced

If you are a large business that prefers dedicated customer support and advanced analytics, the Advanced subscription plan is designed for you. It advertises free online training classes, batch invoices, and automated revenue recognition. You will be assisted by a dedicated account manager and gain personalized user permissions. To ensure timely decisions, active reporting tools can be brought to use.

By paying a monthly $200, the account can be accessible to 25 users and enjoy the benefits of advanced forecasting with Fathom. Not only that, QuickBooks Online Essentials facilitates the latest data sync features and premium apps such as Bill.com, LeanLaw, and DocuSign.

QuickBooks Online Self-Employed

This is a separate subscription plan for freelancers, independently working users, and self-employed contractors. It offers one-user access for a monthly $15 or above. You can track various expenses, send invoices to customers, and capture & send regular receipts. Managing accounts receivables and connecting bank accounts are some of the accommodations for QuickBooks subscribers.

The Self-Employed subscription allows freelancers to track miles on their smartphone (on the app) and organize their schedule efficiently to prepare for the next project and pursue new clients. This subscription also purveys essential consumer support options comprised of quarterly tax estimation and primary reporting. It is a bummer that important features such as budget forecasting, project accounting, and account payables management are excluded from this plan.

QuickBooks Pricing and Additional Fees

To understand exactly how much does QuickBooks Online costs, it is essential to analyze the subsidiary costs included in the terms. For instance, you will be charged extra dollars if you request the add-on features available to all subscribers. Whether it’s online integration, standard checks, or live bookkeeping, every small benefit you enjoy will be a little heavier on the pocket.

In addition to the initial subscription charges, you will be liable to pay the following fees to maintain your QuickBooks account.

Business Capital Loan

If you are a small business in dire need of funding, QuickBooks will offer you a capital loan to help you land on your feet. You can invest it in a new opportunity or to pay employee wages. Nobody will inquire about the reason for requesting the loan if you meet the eligibility criteria.

But that’s not all. Depending on the loan amount, QuickBooks will demand APRs and weekly payments. The Annual Percentage rate starts from 9.99% and higher based on the term length and credit score.

Payment Gateway Charges

QuickBooks Online pricing is also dependent on your payment gateway. You can either use the company’s proprietary gateway or choose from the 25 offered gateways of your preference. Regardless, this is an average estimate of what you will be charged;

- 1% for ACH transfer

- 9% plus $0.25 for invoices

- 4% plus $0.25 for swiped card transactions

- 4% plus $0.25 for keyed-in credit card transactions

Tax Support

In a hurry to know the exact cost, you might forget to consider that QuickBooks demands extra charges for tax forms that you can purchase from Intuit. QuickBooks Online facilitates kits with envelopes as you have to file business taxes manually instead of online. Based on the number of forms, the cost starts from $17.99.

Online Integration

QuickBooks Online facilitates integration with over 750 platforms for you to benefit from additional features. Most of these integrations are included in the monthly subscription fee, while some are charged individually. Nevertheless, if you plan on enjoying add-on features, be prepared to embrace the dent in your pocket; online integrations come with a huge price tag.

QuickBooks Checks

For convenience, you can purchase business wallet checks, standard checks, and vouchers directly from QuickBooks but for a price. The standard QuickBooks check costs $46.26 per 50 checks. An estimate of QuickBooks pricing for some other physical checks goes as follows;

- $47.07 for 50 wallet checks

- $70.79 for 300 manual checks

- $71.68 for 50 voucher checks

- $$42.79 for 120 personal checks

- $113.74 for 250 office checks

Remember that these are just the starting prices. The total can vary depending on the type of check.

Live Bookkeeping

Purchasing software and knowing how to utilize it to gain maximum productivity are entirely separate things. With QuickBooks’ live bookkeeping facility, certified experts will teach you how to operate the available features and manage your books. Based on your company’s size, the price range is $200 to $600 monthly. The package values account reconciliation, income statements, and balance sheets.

Account Setup

As easy as it seems, setting up your QuickBooks account can be difficult for the first time. You will find yourself stressing about several things that must go right on your first try. By paying $50, you can stop worrying about starting off on the wrong foot and ask unlimited questions in a session with a certified expert. This is a small fee to learn to set up the account correctly the first time.

QuickBooks Checking

Even though QuickBooks offers a free checking account with valuable services such as debit card access, QuickBooks Envelopes, and forecasting, maintaining this account is not all free. You will be charged additional fees that are not disclosed upfront.

QuickBooks Online Payroll Plans

Another important factor while determining ‘how much does QuickBooks Online cost?’ is considering the payroll pricing. QuickBooks offers three payroll plans: Core, Premium, and Elite. The plan you choose and what you pay for depends on the features you require.

- The Core payroll plan costs $5 per employee with a $75 monthly fee. This is the most basic plan and includes employee benefits, payroll tax filing, and automated payrolls.

- The Premium plan demands a monthly $160 with $8 per employee and offers same-day deposit, automated paycheck control, and time tracking.

- The monthly and per-employee fee of the Elite plan is $125 plus $10. Penalty protection and basic troubleshooting come under this plan.

These payroll plans can be packaged with your subscription plans to give you a total of what you pay for both.

What is QuickBooks Online Best for?

Considering that you will be paying a ridiculous amount to maintain the accounting software, it is logical to know if it is compatible with your business. Instead of going ahead and signing up hastily, you need to slow down and ask yourself if QuickBooks Online is the right pick for you. You need to know all the trade-offs of the said software. Who benefits the most from a QuickBooks Online account is also a significant consideration.

QuickBooks Online is best recommended for freelancers, professional accountants, mid-sized companies with diverse clientele, large enterprises with full-fledged accounting teams, growing companies, fully functioning small businesses, self-employed users, and independent contractors.

Another thing that counts in this discussion is the price range. It won’t be a lie to say that maintaining a QuickBooks account is tough on the wallet. Besides the hefty subscription fee, users worry about a list of additional charges that are not affordable for everyone. The subscription plan that a user can afford may lack the right features or adequate support.

You are supposed to clarify these things head-on, allowing QuickBooks to benefit your company and not cause extreme inconvenience.

How to Save Money on QuickBooks Online?

Even though QuickBooks is an expensive software, it is not entirely impossible to maintain. If you are someone who is desperately in need of a QuickBooks subscription and doesn’t want to consider switching to another provider, this part of the article is especially for you. Here, we will discuss a few simple ways to lower your QuickBooks Online fee and make it less budget-draining.

Be Quick to Grab Discounts

QuickBooks often lists sales and discounts on the official website for promotional reasons. Contacting a salesperson and being active on the website can help you save some money. You will be eligible for better discounts while switching from QuickBooks Desktop to QuickBooks Online. Be aware that availing the 30-day free trial before buying the subscription would exempt you automatically from any discount deals.

But here is some good news to cheer you up: QuickBooks Online offers 50% off on all subscriptions to users who do not request a free trial. You can always test-drive the software instead of opting for the free 30-day trial.

Decide What Plan Suits You

Another crucial point to be noted concerns the subscription plans. As mentioned earlier, QuickBooks offers a series of subscriptions to pick according to your requirements. Signing up for the wrong pricing plan would only cause a strain on your budget instead of delivering the expected outcome. As a result, you will have several unrequired features with very little money to maintain the account. Here are some tips to avoid all of that;

- Research the available options to find out what plan suits your needs. If you are a freelancer working single-handedly, the Self-Employed Plan is for you. But if you are a small business with a small team of employees, you should opt for the Simple Start plan. The Plus Plan is the right choice for you if your business is expanding its reach. Whereas the Advanced Plan is designed solely for large enterprises demanding additional support.

- You can downgrade or upgrade your subscription anytime. Instead of with the wrong plan, you can purchase the Simple Start Plan and upgrade as your business evolves.

- If you realize that most of the advanced features are being wasted on your hands, downgrade to the more suitable subscription plan.

Eliminate the Extra Costs

QuickBooks checks are ridiculously pricy. Buying physical checks from another vendor would prove less expensive. QuickBooks Online payrolls are not so cheap either. Start with Core to see if it’s adequate for your payroll needs. You can always switch to another payroll plan if your preferences shift.

Unsubscribe from Unwanted Integrations

QuickBooks Online offers a series of third-party integrations, but choosing the right one can be confusing. In some cases, your QuickBooks management features are adequate. You might not need to integrate with another software application as the offered features are already available in your QBO plan. Avoid paying extra for what you already have and ditch the unnecessary integrations.

Final Verdict on QuickBooks Online Pricing for 2023

It is impossible to decipher the exact cost of keeping a QuickBooks Online account, but that does not mean you should not figure out an estimate. If you plan to create a more practical budget for your company, you need to know everything that affects the pricing. It will give you some clarity on calculating the total cost.

QuickBooks Online is an extraordinary platform offering convenience in exchange for money. Yet, it’s not your only option. There are many alternative accounting software facilitating similar features at a lower price. Nevertheless, if you are willing to ignore the price range, QuickBooks Online purveys unbeatable facilities that can drastically improve your business management system.