Are you looking to propel your business towards unparalleled success through innovative pricing strategies? Imagine having a consistent stream of revenue while keeping customers engaged and loyal. Subscription pricing models offer a unique opportunity to unlock the full potential of your business.

In today’s subscription-driven business landscape, selecting the right pricing model can make all the difference. Effective pricing strategies not only attract new customers but also ensure their continued use of your product or service. Are you ready to dive into the world of subscription pricing models to revolutionize the way you do business?

This blog will delve into the best practices and strategies for pricing your subscription-based services, retaining customers, and selecting the ideal billing system for your business. Discover valuable insights, case studies, and actionable tactics to set the right subscription price, maximize revenue growth, and enhance customer satisfaction. Elevate your business game with strategic subscription pricing!

Introduction to Subscription Billing Models

Subscription billing models have gained significant popularity in today’s subscription-driven business landscape. These models offer businesses a recurring revenue stream, allowing them to build long-term relationships with customers and foster sustainable growth.

At its core, a subscription billing model involves offering products or services to customers on a recurring basis, typically through a predetermined subscription plan. Instead of making one-time purchases, customers pay a set price at regular intervals, such as monthly or annually, to continue accessing the offerings.

One of the key benefits of adopting a subscription billing model is the predictability of revenue streams it offers. Instead of relying solely on one-time sales, businesses can cultivate a loyal customer base and increase customer lifetime value. This steady revenue stream allows businesses to plan and allocate resources more effectively, fostering stability and facilitating long-term growth.

Furthermore, subscription billing models often result in improved customer satisfaction and a better overall customer experience. By providing customers with continuous access to products or services through a subscription plan, businesses can ensure consistent and uninterrupted value delivery. Customers also appreciate the convenience and flexibility of subscription models, as they can easily manage their subscriptions and adjust them according to their needs.

In the next sections, we will delve deeper into pricing strategies, customer retention tactics, selecting the right billing system, and explore various pricing models suitable for subscription billing. These elements are crucial to the success of businesses operating in a subscription-based business model and will be further explored to provide valuable insights and strategies.

Understanding Pricing Strategies

Pricing strategies play a crucial role in the success of businesses operating in the subscription billing model. By strategically setting prices, businesses can attract and retain customers, maximize revenue, and ensure long-term profitability. In this section, we will define different pricing strategies and explore their significance for businesses considering subscription billing models.

Cost Plus Margin Pricing Strategy

The cost plus margin pricing strategy is widely used across industries. It involves calculating the cost of producing or delivering a product or service and then adding a predetermined profit margin to determine the final price. This strategy ensures that businesses cover their costs and generate a desired level of profit.

Competitive Pricing Strategy

In a competitive pricing strategy, businesses set their prices based on the prevailing prices in the market. This approach aims to align the pricing with the competition to attract customers. By offering prices that are in line with or lower than competitors, businesses can gain a competitive edge and capture market share.

Price Skimming

Price skimming is a strategy where businesses set high initial prices for their products or services and gradually reduce them over time. This approach allows businesses to maximize profits during the early stages when demand may be higher and customers are willing to pay a premium. As competition increases or market saturation occurs, businesses can lower their prices to attract a broader customer base.

Penetration Pricing

Penetration pricing involves setting low introductory prices to quickly penetrate the market and gain market share. By offering products or services at lower prices than competitors, businesses can attract price-sensitive customers and encourage them to try their offerings. Once a significant customer base is established, businesses may gradually increase prices or introduce additional features to improve their profitability.

Value Pricing Strategy

Value pricing focuses on pricing products or services based on the perceived value they provide to customers. This strategy takes into account factors such as quality, features, benefits, and the customer’s willingness to pay. By aligning prices with the perceived value, businesses can effectively communicate the worth of their offerings and justify higher price points.

In conclusion, understanding pricing strategies is essential for businesses considering subscription billing models. Each pricing strategy has its own advantages and suitability depending on the target audience, market dynamics, and business goals. By carefully selecting and implementing the right pricing strategy, businesses can optimize their revenue, attract and retain customers, and achieve long-term success in the subscription-based business landscape.

Importance of Customer Retention in Subscription Billing

Customer retention is crucial for businesses operating in a subscription billing model. When customers continually use and pay for your services, it not only ensures a steady stream of revenue but also contributes to long-term business success. On the other hand, high customer churn rates can negatively impact profitability and hinder growth. Therefore, implementing effective tactics to improve customer retention is essential.

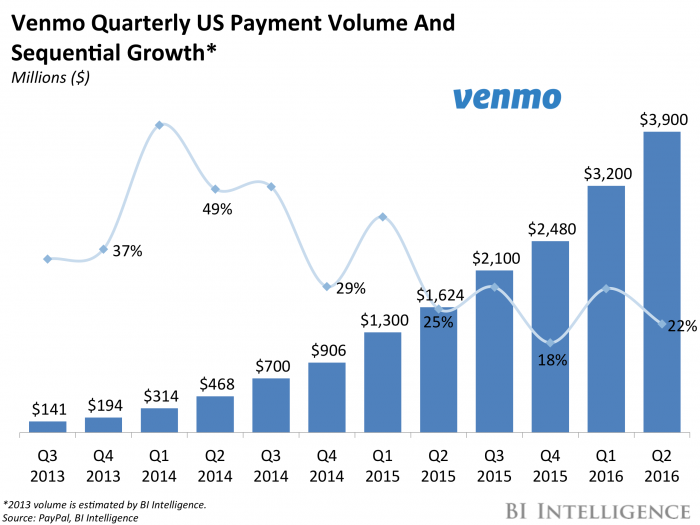

The Impact of Customer Churn on Revenue

Customer churn refers to the rate at which customers discontinue their subscriptions or stop using your services. Every time a customer churns, it results in lost revenue and potential future sales. High churn rates can significantly impact your bottom line and hinder revenue growth. Moreover, acquiring new customers is often more expensive than retaining existing ones, making customer retention even more critical.

Tactics to Improve Customer Retention

To combat churn and improve customer retention, businesses can employ various effective tactics. Here are some strategies to consider:

1. Enhance the customer experience: Providing exceptional customer service and ensuring a seamless user experience can significantly contribute to customer satisfaction and retention. Promptly address customer inquiries or concerns, and constantly seek feedback to identify areas for improvement.

2. Offer personalized incentives and rewards: Implement loyalty programs, personalized discounts, or exclusive offers for long-term customers. By recognizing and rewarding their loyalty, you incentivize customers to stay subscribed and engaged with your services.

3. Continuously deliver value: Regularly assess your offerings to ensure they meet customer expectations and provide ongoing value. Adding new features or improving existing ones based on customer feedback can enhance their experience and increase satisfaction.

4. Communicate regularly: Stay connected with your customers through personalized emails, newsletters, or in-app messages. Proactively share updates, new features, and relevant information to keep your subscribers engaged and informed.

5. Implement proactive churn management: Identify early warning signs of potential churn, such as decreased usage or engagement levels, and take proactive measures to retain at-risk customers. Offer targeted promotions or personalized assistance to address their concerns and encourage continued subscription.

6. Focus on customer success: Provide resources, tutorials, and educational content to help your customers maximize the value they derive from your services. By supporting their success, you establish strong relationships and increase the likelihood of long-term retention.

7. Foster a sense of community: Create platforms for customers to connect, share experiences, and provide feedback. Building a community around your brand encourages customer loyalty and can lead to customer advocacy.

Remember, customer retention is not a one-time effort but an ongoing process. Continuously monitor customer satisfaction, analyze churn patterns, and adapt your strategies accordingly.

In conclusion, recognizing and prioritizing the importance of customer retention is vital for businesses operating in a subscription billing model. By implementing effective tactics to improve customer satisfaction and engagement, you can mitigate churn, foster long-term relationships, and ultimately drive business growth and success.

Selecting the Right Billing System

When it comes to running a successful subscription-based business, choosing the right billing system is crucial. A well-suited billing system can streamline your operations, enhance customer satisfaction, and ensure accurate financial reporting. In this section, we will provide you with guidelines on how to choose the right billing system for your subscription-based business, discuss key considerations, highlight important features to look for, and navigate potential pitfalls to avoid.

Key Considerations

When evaluating billing systems, several key considerations should be at the forefront of your decision-making process. These considerations include:

1. Scalability: Your chosen billing system should have the capability to handle the growth and evolving needs of your business. Look for a system that allows you to easily scale up or down and accommodate increasing customer volumes without compromising performance.

2. Flexibility: Every subscription-based business is unique, so it’s important to choose a billing system that can adapt to your specific billing requirements. Ensure that the system supports different billing frequencies, pricing models, and payment methods to cater to your customer base.

3. Integration: Seamless integration with other business-critical systems, such as customer relationship management (CRM) platforms, accounting software, and customer support tools, is essential. Look for a billing system that offers robust integrations or APIs to automate data synchronization and streamline your workflows.

Key Features to Look for

To effectively manage your subscription billing processes, there are several key features you should prioritize in a billing system:

1. Automated Billing and Invoicing: Look for a billing system that can automate billing and invoicing tasks, reducing manual efforts and ensuring accuracy. Features such as automated recurring billing, proration calculations, and invoice generation will save you time and help you maintain billing consistency.

2. Subscription Management: A good billing system should provide comprehensive subscription management capabilities. This includes managing customer subscriptions, handling upgrades and downgrades, enabling trial periods, and supporting add-ons or upselling options.

3. Payment Gateways: Ensure that the billing system integrates with popular payment gateways and supports a wide range of payment options. Offering convenience to your customers by accepting various payment methods can improve customer satisfaction and increase conversions.

4. Dunning Management: Dunning refers to the process of following up with customers whose payments have failed. Look for a billing system that has robust dunning management features, such as automated retries, customizable email notifications, and the ability to handle different payment failure scenarios.

Pitfalls to Avoid

When selecting a billing system, it’s important to be aware of potential pitfalls that can hinder your business operations. Avoid these common mistakes:

1. Lack of Scalability: Choosing a billing system that cannot accommodate the growth of your business can lead to operational inefficiencies and hinder your ability to scale. Ensure that the system you choose is flexible and can handle your future growth plans.

2. Inadequate Support and Documentation: Opt for a billing system that provides comprehensive support channels, including documentation, knowledge base articles, and responsive customer support. This will ensure that any issues or questions you encounter can be resolved in a timely manner.

3. Ignoring Security Measures: Security is a critical aspect of any billing system. Ensure that the system adheres to industry-standard security protocols and is compliant with regulations such as Payment Card Industry Data Security Standard (PCI DSS). Protecting your customers’ sensitive payment information should be a top priority.

Choosing the right billing system is a strategic decision that can have a significant impact on the success of your subscription-based business. Consider the key considerations, such as scalability and flexibility, prioritize essential features like automated billing and subscription management, and avoid common pitfalls. By doing so, you’ll be well-equipped to handle your billing processes efficiently, ensuring smooth operations and customer satisfaction.

Pricing Models for Subscription Billing

Subscription billing models offer businesses the opportunity to generate recurring revenue and build long-term customer relationships. To succeed in this model, it is crucial for businesses to select the right pricing model that aligns with their product or service and meets their customers’ needs. In this section, we will explore different pricing models suitable for subscription billing, discuss the pros and cons of each model, and provide examples of businesses that have successfully implemented them.

1. Prepaid Subscriptions

Prepaid subscriptions require customers to pay in advance for a set period of time, typically monthly or annually. This model offers businesses the advantage of upfront revenue and improved cash flow. It also encourages customer commitment and reduces the risk of churn. Example: Netflix offers prepaid subscription plans where customers can pay for a certain number of months in advance.

2. Freemium

The freemium model provides both free and paid subscription options. Customers can access a limited version of the product or service for free, and upgrade to a paid plan for additional features or premium content. Freemium helps businesses attract a larger user base and convert free users into paying customers. Example: Dropbox offers a free storage plan with limited storage capacity and a paid plan with more storage and advanced features.

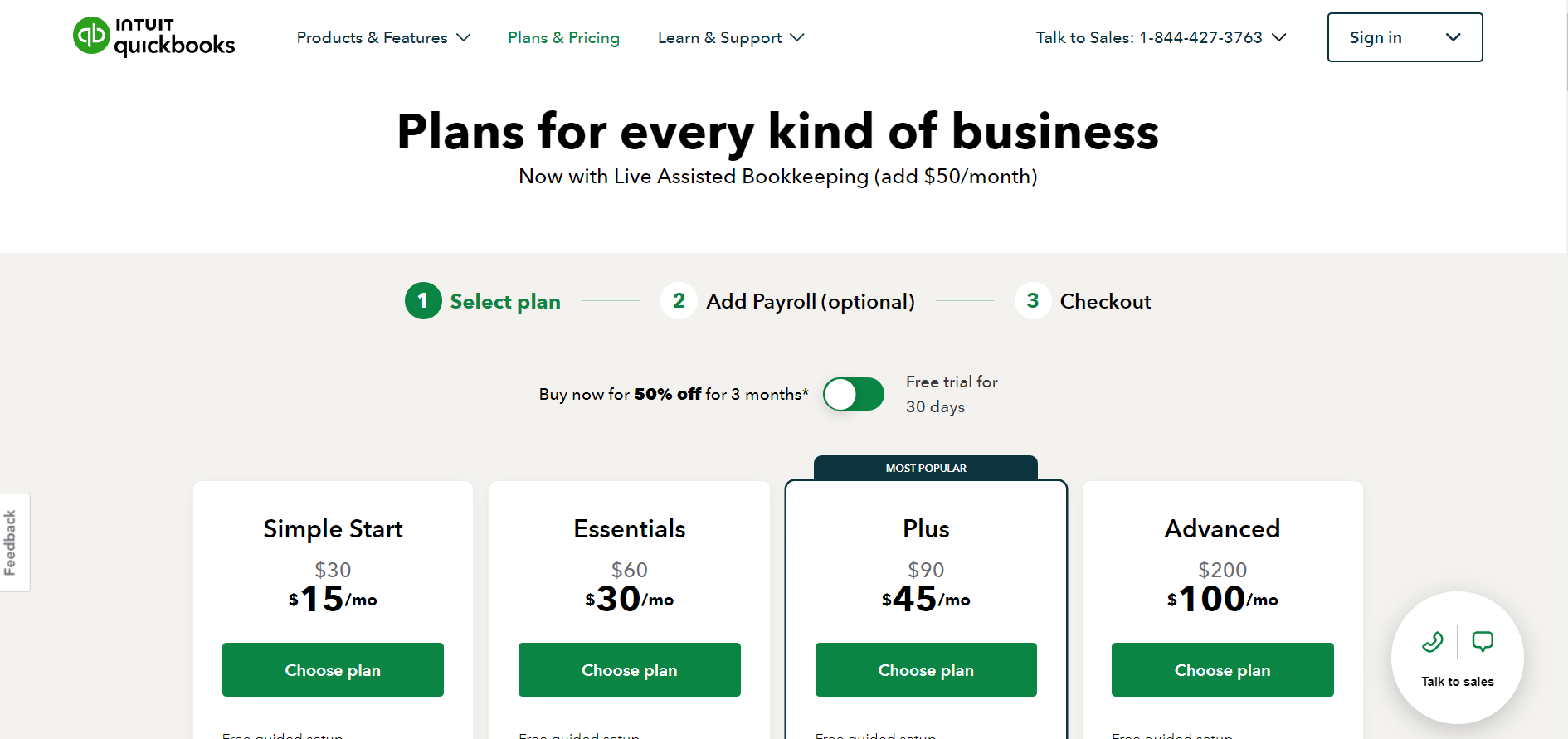

3. Tiered Pricing

Tiered pricing involves offering different subscription tiers at varying price points, each with its own set of features and benefits. This allows businesses to cater to different customer segments and capture a wider range of customers. It also provides the opportunity to upsell customers to higher-priced tiers as they see the value in additional features. Example: Mailchimp offers tiered pricing for its email marketing service, with different plans based on the number of subscribers and additional features.

4. Usage-based Pricing

Usage-based pricing charges customers based on their actual usage or consumption of the product or service. This model is particularly suitable for businesses that offer software-as-a-service (SaaS) or utility-based services. It allows customers to pay for what they use and provides businesses with the flexibility to scale their pricing based on customers’ needs. Example: Amazon Web Services (AWS) charges its customers based on the amount of cloud resources they consume.

5. Per-user Pricing

Per-user pricing sets the subscription price based on the number of users or seats accessing the product or service. This model is commonly used for collaboration tools, project management software, and other team-oriented solutions. It provides businesses with predictable revenue as they grow their user base and encourages companies to adopt the product or service across the organization. Example: Slack offers a per-user pricing model, where businesses pay for each user accessing the platform.

Each pricing model has its own advantages and considerations, and businesses should carefully evaluate their product, target audience, and revenue goals before selecting the most suitable model. It’s important to test different approaches, gather customer feedback, and iterate on pricing strategies to find the optimal pricing model for your subscription-based business.

Remember, subscription pricing is not set in stone and can be adjusted as the market evolves and customer needs change. Stay agile, monitor industry trends, and continuously assess the effectiveness of your pricing strategy to stay competitive and maximize your subscription revenue.

By understanding the different pricing models available and learning from successful implementations in various industries, you can make informed decisions and unlock the full potential of subscription billing for your business.

Remember to choose a billing system that supports your chosen pricing model and provides the necessary flexibility and automation to manage your subscription business effectively.

Strategies for Pricing Subscription-Based Services

Pricing subscription-based services effectively is crucial for businesses operating in a subscription billing model. It involves considering various factors such as the value delivered, competitor pricing, and cost-plus pricing. By implementing the right strategies, businesses can maximize revenue, attract new customers, and retain existing ones. In this section, we will explore effective strategies for pricing subscription-based services and provide guidelines for determining the right price.

Value-Based Pricing

Value-based pricing is a strategy that focuses on the perceived value of the subscription service to the customer. Instead of solely considering costs and competition, businesses determine the price based on the unique benefits their service offers. To employ this strategy, it is essential to understand customers’ preferences and the value they derive from the subscription. By aligning the price with the perceived value, businesses can optimize their revenue and attract customers willing to pay for the benefits provided.

Competitor-Based Pricing

Competitor-based pricing involves setting the price of a subscription service based on the prices charged by competitors. This strategy requires businesses to conduct thorough market research, analyze competitor pricing structures, and position their offering accordingly. By pricing competitively, businesses can attract customers who compare prices and entice them with a value proposition that justifies the price. However, it is important to ensure that pricing remains sustainable and profitable while still offering competitive advantages.

Cost-Plus Pricing

Cost-plus pricing involves setting the price of a subscription service by calculating the costs involved in delivering it and adding an appropriate margin. This strategy ensures that the price covers all expenses, including production costs, overheads, and a desired profit margin. By analyzing the costs accurately and factoring in a margin that ensures profitability, businesses can establish pricing that aligns with their financial goals. However, it is important to regularly review costs and adjust prices to maintain competitiveness in the market.

Guidelines for Pricing Determination

When determining the right price for a subscription-based service, businesses should consider the following guidelines:

1. Understand the target market: Conduct market research to gain insights into the target audience’s preferences, purchasing power, and willingness to pay.

2. Analyze the value proposition: Clearly communicate the unique benefits and value the subscription service provides compared to competitors.

3. Consider customer segments: Segment customers based on their willingness to pay and adjust pricing tiers or plans accordingly.

4. Test different pricing models: Experiment with different pricing structures, such as tiered pricing, to cater to different customer segments and maximize revenue.

5. Monitor market conditions: Stay updated on industry trends, competitive pricing changes, and customer demands to adjust pricing strategies accordingly.

6. Emphasize customer feedback: Continuously gather and analyze customer feedback to understand their perception of the pricing and make necessary adjustments.

Remember, pricing strategies should evolve based on market conditions, customer feedback, and business goals. Regularly analyze the effectiveness of the chosen strategy and make necessary adjustments to ensure continued success in the subscription-based business model.

Conclusion

Effective pricing strategies are essential for businesses operating in a subscription-based model. By implementing value-based pricing, competitor-based pricing, or cost-plus pricing, businesses can optimize revenue and attract the right customers. Remember to consider market conditions, customer preferences, and the unique value proposition of the subscription service. Regularly review and adjust pricing strategies to ensure competitiveness and maximize long-term success in the subscription-based business landscape.

Conclusion and Key Takeaways

In conclusion, implementing a subscription billing model can be a strategic approach for businesses seeking long-term success. By following the right pricing strategies, retaining customers, and selecting the appropriate billing system, businesses can thrive in today’s subscription-driven business landscape.

Here are the key takeaways from this article:

1. Pricing Strategies for Subscription-Based Services

– Consider value-based pricing, competitor-based pricing, and cost-plus pricing to set the right price for your subscription-based services.

– Regularly evaluate and adjust your pricing strategies based on market conditions and customer feedback.

– Analyze your competitors’ pricing structures to ensure you offer a competitive and appealing price.

2. Importance of Customer Retention

– Prioritize customer retention to minimize churn and maximize revenue growth.

– Implement effective customer retention tactics such as providing exceptional customer experiences, offering personalized subscriptions, and continuously adding value to your offerings.

– Continuously monitor customer satisfaction and seek feedback to improve your subscription services.

3. Selecting the Right Billing System

– Choose a billing system that meets the specific needs of your subscription-based business.

– Consider factors such as scalability, flexibility, integration capabilities, security features, and ease of use when selecting a billing system.

– Avoid pitfalls such as selecting an overly complex system or one that does not align with your business goals.

4. Different Pricing Models

– Explore various pricing models such as prepaid subscriptions, freemium, tiered pricing, and usage-based pricing to find the best fit for your business.

– Assess the pros and cons of each model and determine the most suitable option based on your target audience, market share, and revenue goals.

– Consider offering a variety of subscription plans to cater to different customer segments and increase customer engagement.

5. Case Studies and Success Stories

– Seek inspiration from successful businesses that have implemented subscription billing models.

– Learn from their pricing strategies, customer retention tactics, and overall business success.

– Adapt and apply proven strategies to your own subscription-based business.

In summary, unlocking success with subscription pricing models requires careful consideration of pricing strategies, customer retention tactics, and the selection of the right billing system. Continually assess and refine your approach to maximize revenue growth, customer satisfaction, and overall business success.