Are credit cards and PayPal the only payment methods for e-commerce transactions? In today’s rapidly evolving digital landscape, businesses are increasingly looking beyond these traditional options to embrace alternative e-commerce payment methods. From digital wallets and bank transfers to buy now, pay later services and mobile payments, there is a diverse array of payment options available to cater to the changing needs and preferences of consumers.

This blog explores the world of alternative e-commerce payment methods, going beyond the confines of credit cards and PayPal. We’ll delve into the latest trends and developments in the payment landscape, discussing the benefits and advantages of adopting alternative payment methods for your business. Whether you’re looking to expand your customer base, improve conversion rates, or enhance customer satisfaction, understanding and implementing these innovative alternatives can make a significant impact on your e-commerce success.

Join us as we navigate through the realm of digital commerce, examining case studies, providing actionable tips and strategies, and shedding light on the rise of alternative payment methods in different regions of the world. Discover how you can stay ahead of the curve and unlock new opportunities by embracing the world of alternative e-commerce payment options.

Introduction to Alternative Payment Methods: Beyond Credit Cards

The world of e-commerce continues to evolve, and so do the payment methods. While credit cards and PayPal have long been the dominant players, there is a growing demand for alternative payment solutions that cater to the diverse needs of consumers. Traditional methods have their limitations, such as high transaction fees, fraud risks, and restricted accessibility for unbanked populations.

Alternative payment methods offer a solution to these challenges and provide an opportunity for businesses to expand their customer base. These methods provide customers with more options to complete transactions conveniently and securely. By diversifying payment options, businesses can appeal to a wider audience and enhance the shopping experience for their customers.

By integrating alternative payment methods, businesses can tap into emerging trends and consumer preferences. From mobile wallets like Apple Pay and Google Pay to bank transfers and direct debits, there is a diverse array of options available.

In the sections that follow, we will explore various alternative payment methods in depth, highlighting their benefits, processes, and implications for businesses. Let’s explore the world of alternative e-commerce payment methods beyond credit cards and PayPal and uncover how they can revolutionize the digital transaction landscape.

Digital Wallets: The Convenience of Contactless Payments

Digital wallets have rapidly gained popularity in the world of e-commerce, providing users with a convenient and secure way to make contactless payments. Two widely recognized digital wallet options are Apple Pay and Google Pay, offering users a seamless and effortless payment experience.

Convenience at Your Fingertips

Digital wallets allow users to store their payment information securely on their mobile devices, eliminating the need to carry physical credit cards or cash. With just a few taps, customers can complete transactions in-store or online, making the checkout process faster and more convenient. This convenience is particularly valuable for customers who are always on the go, as they can complete purchases with just a touch or a scan.

Enhanced Security Features

One of the key advantages of digital wallets is the heightened security they provide. When making a payment, digital wallets utilize tokenization, a process that substitutes sensitive card information with a unique token. This means that the user’s actual card details are never shared with the merchant, reducing the risk of fraud and unauthorized access to personal information. Additionally, many digital wallets require the use of biometric authentication, such as fingerprint or facial recognition, adding an extra layer of security to the payment process.

Acceptance Among Merchants

As the popularity of digital wallets continues to grow, more and more merchants are embracing this payment method. Major retailers, online platforms, and even small businesses are increasingly offering digital wallet options to cater to customer preferences. This widespread acceptance provides customers with a wider range of payment options and a smoother overall shopping experience.

Looking Ahead

The convenience and security offered by digital wallets make them a promising alternative payment method for e-commerce transactions. As technology advances and consumer preferences evolve, we can expect to see further innovations in the digital wallet landscape. It is important for businesses to stay updated with the latest trends and consider incorporating digital wallet options to meet the growing demand for contactless payments.

In conclusion, digital wallets bring unparalleled convenience and security to the world of e-commerce. Their ease of use and enhanced security features make them an attractive choice for both customers and merchants. By offering digital wallet payment options, businesses can provide their customers with a seamless and hassle-free payment experience while staying ahead of the curve in the ever-evolving world of alternative payment methods.

Bank Transfers and Direct Debits: ACH and Beyond

Bank transfers and direct debits have become popular alternative payment methods for e-commerce transactions. They offer numerous benefits for both businesses and customers, providing a secure and efficient way to process payments. Here, we will delve into the advantages of using bank transfers and direct debits, as well as the processes involved.

Benefits of Bank Transfers and Direct Debits

1. Security: Bank transfers and direct debits provide a high level of security. Customers can make payments directly from their bank accounts, reducing the risk of fraud associated with sharing credit card or debit card details online.

2. Cost-Effective: Unlike credit card transactions that involve fees and percentages, bank transfers and direct debits often have lower transaction costs, especially for large transactions. This makes them an attractive option for both customers and businesses, allowing for cost savings.

3. Efficient Processing: Bank transfers and direct debits provide quick and efficient payment processing. Funds are transferred directly from the customer’s bank account to the merchant’s account, eliminating intermediaries and speeding up the payment cycle.

The Process of Bank Transfers and Direct Debits

1. Authorization: Customers need to authorize the merchant to withdraw funds from their bank accounts through a direct debit mandate. This can be done online or by filling out a form provided by the merchant.

2. Initiation: Once the authorization is in place, the merchant initiates the payment request. This involves providing the customer’s bank details, such as account number and routing number, along with the requested amount.

3. Processing: The payment request is processed through the Automated Clearing House (ACH) system, a network that facilitates electronic payments in the United States. The ACH system securely transfers funds between banks.

4. Settlement: After processing, the funds are transferred from the customer’s bank account to the merchant’s account. Settlement times can vary depending on the banks involved, but typically range from one to three business days.

Conclusion

Bank transfers and direct debits offer a secure, cost-effective, and efficient alternative to traditional credit card payments in e-commerce. Their benefits, including enhanced security, lower transaction costs, and streamlined processing, make them an attractive choice for both businesses and customers. By incorporating bank transfers and direct debits as payment options, businesses can cater to a wider audience and provide a diverse range of payment methods, ultimately increasing customer satisfaction and improving conversion rates.

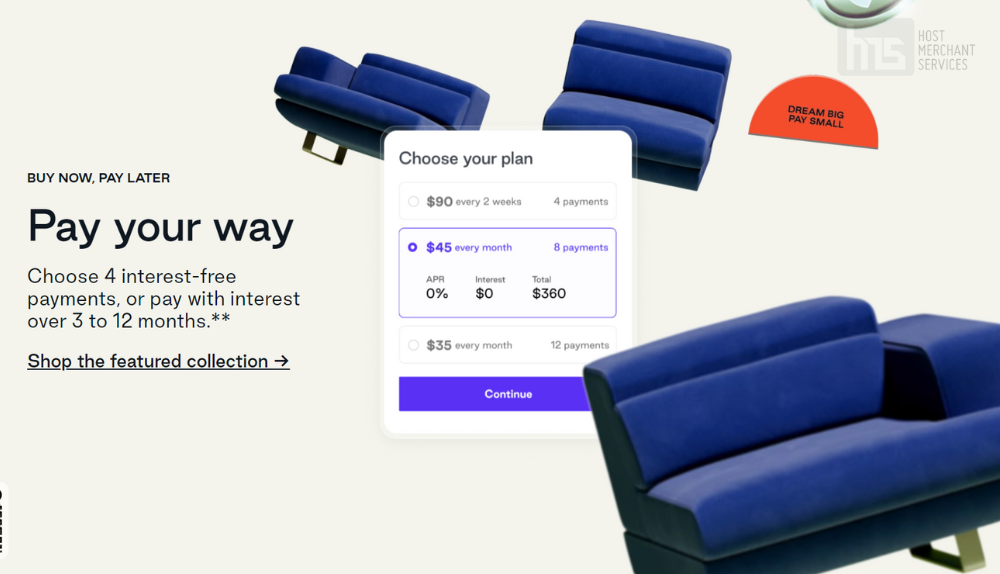

Buy Now Pay Later (BNPL): Flexible Payment Solutions

Buy Now Pay Later (BNPL) services have gained significant popularity in the e-commerce industry, revolutionizing traditional payment methods. With BNPL, customers have the option to make a purchase and defer the payment, allowing them greater flexibility and affordability. This payment solution has shown immense potential in increasing customer conversions and driving sales.

Convenience and Flexibility

One key advantage of BNPL services is the convenience they offer to customers. By allowing them to split payments into smaller installments over time, BNPL providers reduce the financial burden associated with large purchases. This flexibility enables customers to make purchases that may have been otherwise unaffordable. Moreover, the application and approval process for BNPL services is usually quick and easy, making it an attractive payment option for customers.

Appeal to a Wider Customer Base

BNPL services have also proven to be an effective way to attract and retain customers. For younger consumers who may not have access to credit cards or prefer not to use them, BNPL provides a viable alternative. By offering BNPL as a payment option, businesses can tap into a larger customer base and cater to the preferences of various demographics.

Increasing Conversion Rates

By implementing BNPL services, businesses can potentially boost their conversion rates. Studies have shown that offering BNPL can lead to higher average order values and increased customer loyalty. The psychology behind BNPL is that it removes the immediate obstacles to purchase, making it more likely for customers to complete transactions. The option to pay in installments can also reduce cart abandonment rates, as customers feel more comfortable with the affordability and flexibility offered by BNPL services.

In conclusion, Buy Now Pay Later (BNPL) services have emerged as flexible payment solutions that benefit both customers and businesses alike. By embracing BNPL, businesses can increase their customer base, improve conversion rates, and provide a more convenient and affordable shopping experience. As the e-commerce landscape continues to evolve, BNPL is a payment option that should not be overlooked.

Cryptocurrencies: Embracing the Digital Currency Revolution

Cryptocurrencies, led by Bitcoin, have revolutionized the way we perceive and handle money. With the potential to disrupt traditional financial systems, these digital currencies are gaining popularity as alternative payment methods in the world of e-commerce. Here, we will explore the rise of cryptocurrencies and their impact on online transactions.

The Rise of Cryptocurrencies

Cryptocurrencies, such as Bitcoin, have emerged as decentralized digital currencies that utilize blockchain technology for secure and transparent transactions. While Bitcoin remains the most well-known cryptocurrency, several others, including Ethereum and Litecoin, have also gained prominence. This rise in popularity can be attributed to several factors, including their decentralization, anonymity, and potential for value appreciation.

Advantages for Alternative Payment Methods

The adoption of cryptocurrencies as alternative payment methods in e-commerce presents numerous advantages. First and foremost, they offer a high level of security and fraud protection due to the cryptographic nature of transactions. Furthermore, the decentralized nature of cryptocurrencies eliminates the need for intermediaries, reducing transaction fees and ensuring faster settlement times.

Global Accessibility and Flexibility

Cryptocurrencies facilitate seamless cross-border transactions, eliminating the need for currency conversion and reducing associated costs. This feature is especially beneficial for global e-commerce businesses that cater to an international customer base. Additionally, cryptocurrencies offer greater financial inclusion, enabling individuals without access to traditional banking services to participate in online transactions.

Overcoming Challenges and Building Trust

As with any emerging technology, cryptocurrencies face challenges that must be addressed for widespread adoption. One such challenge is the volatility of cryptocurrency prices, which can deter some consumers and merchants. However, advancements in stablecoins aim to address this issue by pegging their value to external assets, providing stability.

Transparency is another crucial aspect for building trust in cryptocurrencies. The blockchain technology backing cryptocurrencies allows for public verification of transactions, enhancing transparency and reducing the risk of fraudulent activity.

Integration with E-commerce Platforms

To embrace the digital currency revolution, e-commerce platforms are increasingly integrating cryptocurrency payment options. By accepting cryptocurrencies, merchants can tap into a growing customer base that prefers digital transactions. Moreover, the integration of cryptocurrencies presents an opportunity for businesses to differentiate themselves and attract tech-savvy consumers.

In conclusion, cryptocurrencies have emerged as a viable alternative payment method in e-commerce. With their decentralized nature, security features, and global accessibility, cryptocurrencies offer a new paradigm for conducting online transactions. As the digital currency revolution continues, businesses that embrace cryptocurrencies stand to gain a competitive advantage in the evolving landscape of alternative payment methods.

Prepaid Cards: A Secure and Controlled Spending Solution

Prepaid cards have gained popularity as a secure and convenient alternative payment method for online purchases. With these cards, users can load a specific amount of money onto the card, which can then be used for transactions just like a debit or credit card. Here are some key advantages of using prepaid cards for online purchases:

1. Enhanced Security: Prepaid cards offer an added layer of security, as they are not linked directly to a bank account. This means that even if a prepaid card is compromised, the potential loss is limited to the balance on the card, minimizing the risk of unauthorized transactions and protecting users’ personal and financial information.

2. Budget Control: Prepaid cards enable users to set a spending limit based on the loaded amount. This helps individuals stay on track with their budget and avoid overspending. It is particularly beneficial for those who want to control their online shopping expenses or have a specific budget for online purchases.

3. No Credit Risk: Unlike credit cards, prepaid cards do not require a credit check or impact the user’s credit score. This makes them accessible to a wider range of individuals, including those with no or poor credit history.

4. Convenience and Flexibility: Prepaid cards are widely accepted by online merchants, allowing users to make purchases easily and securely. They can be used for various online transactions, such as shopping, bill payments, and subscription services.

5. Ideal for Gifting: Prepaid cards make for a thoughtful and practical gift, as the recipient can choose to spend the prepaid amount according to their preferences. It eliminates the need for guessing someone’s preferences or worrying about returns or exchanges.

In summary, prepaid cards offer a secure and controlled spending solution for online purchases. With enhanced security features, budget control options, and convenience, they provide users with peace of mind and financial flexibility. Whether used for personal shopping or as a gift option, prepaid cards have become an increasingly popular alternative payment method in the digital commerce landscape.

Mobile Payments: Revolutionizing Transactions on the Go

In today’s fast-paced world, the demand for convenient and streamlined payment options is higher than ever. Mobile payments have emerged as a revolutionary solution, offering consumers the flexibility to make transactions on the go, without the need for physical cash or cards. With the rise of smartphones and the increasing popularity of mobile wallets and payment apps, the way we pay for goods and services is undergoing a transformation.

The Convenience of Mobile Wallets

Mobile wallets, such as Apple Pay and Google Pay, have gained immense popularity due to their convenience and ease of use. By linking your credit or debit card to your mobile device, you can make secure payments with just a tap or scan. No more fumbling for your wallet or entering card details for each transaction. With mobile wallets, you have all your payment information stored in one place, making it quick and hassle-free to complete purchases, whether in-store or online.

Payment Apps for Seamless Transactions

In addition to mobile wallets, payment apps have become increasingly prevalent in the mobile payment landscape. These apps, offered by various financial institutions and payment providers, allow users to send and receive money, split bills, and make payments to merchants directly from their smartphones. With features like instant notifications and transaction histories, payment apps provide a convenient way to track and manage your finances on the go.

The Rise of Mobile Payments

The growth of mobile payments can be attributed to several factors. Firstly, the widespread adoption of smartphones has made mobile payment options accessible to a larger audience. As more individuals own smartphones, the potential customer base for mobile payments continues to expand.

Secondly, the convenience and speed offered by mobile payments have resonated with consumers. The ability to make a payment with just a few taps on your smartphone is not only time-saving but also eliminates the need for physical cash or cards. This is particularly appealing in today’s cashless society, where contactless transactions are becoming the norm.

Enhancing Customer Experience and Convenience

The popularity of mobile payments is driven by the desire for a seamless and effortless payment experience. Whether you are shopping in-store, ordering food delivery, or making online purchases, mobile payments offer a convenient way to complete transactions. By simply tapping your phone or scanning a QR code, you can make payments effortlessly, reducing friction at the checkout and improving the overall customer experience.

The Future of Mobile Payments

As technology continues to evolve, we can expect further advancements in the mobile payment landscape. Features like biometric authentication, such as fingerprint or facial recognition, are already being integrated into mobile payment apps, providing an additional layer of security and convenience.

Furthermore, with the rise of internet-connected devices and the Internet of Things (IoT), mobile payments may extend beyond smartphones. Smartwatches, smart home devices, and even cars with integrated payment capabilities could become part of the mobile payment ecosystem, making transactions even more seamless and integrated into our daily lives.

In conclusion, mobile payments have revolutionized the way we conduct transactions on the go. With the convenience of mobile wallets and the proliferation of payment apps, consumers now have a wide range of options for making seamless and secure payments. As technology continues to advance, the future of mobile payments looks promising, with even more innovative solutions on the horizon.

E-Checks: The Digital Evolution of Traditional Checks

Traditional checks have long been a staple of financial transactions, but the digital age has brought about a transformative evolution known as e-checks. This section will delve into how e-checks have revolutionized the way payments are made, providing a convenient and secure alternative to traditional paper checks.

The Convenience of E-Checks

E-checks offer numerous advantages over their paper counterparts. With e-checks, there is no need for physical delivery or manual processing. Transactions can take place instantly and electronically, eliminating the hassle of mailing checks or waiting for them to clear.

Seamless Integration with Online Platforms

One of the significant benefits of e-checks is their compatibility with online platforms and payment gateways. Businesses can easily incorporate e-check functionality into their e-commerce websites, allowing customers to make purchases using their bank accounts. This integration streamlines the checkout process and offers customers a wider range of payment options, enhancing their overall shopping experience.

Enhanced Security Measures

Security is a top concern in the digital realm, and e-checks have implemented measures to ensure secure transactions. Encrypted transmissions and authentication protocols safeguard sensitive information, mitigating the risk of data breaches. Additionally, digital records provide a trail of payment information, allowing for easy tracking and reconciliation.

Cost-Effectiveness and Efficiency

E-checks are not only convenient but also cost-effective. Businesses can reduce expenses associated with paper checks, such as printing and postage costs. Moreover, the elimination of manual processes translates into improved efficiency and time savings for both businesses and consumers.

Embracing the Future of Payments

As technology continues to advance, e-checks are poised to play a pivotal role in the future of payments. Offering a secure and efficient alternative to traditional checks, e-checks cater to the evolving needs of businesses and consumers alike. By embracing this digital transformation, businesses can increase efficiency, reduce costs, and provide their customers with a seamless payment experience.

When you choose e-checks, you’re embracing the digital evolution of traditional checks, enabling secure and convenient transactions in the modern age.

Cross-Border Payment Solutions: Overcoming Currency Barriers

When it comes to international e-commerce transactions, currency barriers can be a significant challenge for businesses. Converting currencies and dealing with exchange rates can create complexities and increase costs. However, there are various cross-border payment solutions that can help overcome these obstacles and enable smooth transactions.

Currency Conversion Services

One of the key challenges in cross-border transactions is converting currencies. Traditional payment methods often involve multiple currency conversions, leading to higher fees and potential discrepancies. However, currency conversion services like TransferWise and Revolut offer more competitive exchange rates and lower fees compared to banks. These services facilitate seamless currency conversion, providing businesses with access to the global market without incurring hefty expenses.

Digital Payment Solutions

Digital payment solutions have revolutionized the way payments are made across borders. Platforms like PayPal, Stripe, and Payoneer enable businesses to accept payments from customers worldwide, regardless of the currency. These solutions provide a convenient and secure method for transferring funds internationally, reducing the complexities associated with traditional banking systems.

Cross-Border Payment Gateways

Cross-border payment gateways offer specialized solutions designed specifically for international transactions. Companies like Worldpay and Adyen provide businesses with payment processing systems that support multiple currencies and offer localized payment options. These gateways streamline the payment process and ensure a seamless experience for customers, increasing the likelihood of successful transactions.

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies have also emerged as potential solutions for cross-border payments. Cryptocurrencies like Bitcoin and Ethereum eliminate the need for intermediaries, reducing costs and increasing transaction speed. Additionally, blockchain technology provides transparency and security, making it an attractive option for businesses operating on a global scale.

Conclusion

Overcoming currency barriers in cross-border transactions is essential for businesses aiming to expand their reach and tap into the global market. Currency conversion services, digital payment solutions, cross-border payment gateways, and blockchain technology all offer viable options for businesses to smoothly conduct international transactions. By embracing these cross-border payment solutions, businesses can navigate currency barriers and unlock new opportunities in the e-commerce landscape.

The Benefits for Merchants: Enhancing Customer Satisfaction and Conversion Rates

In today’s competitive e-commerce landscape, offering alternative payment methods to customers can provide significant benefits to merchants. By expanding their payment options beyond traditional credit cards and PayPal, merchants can enhance customer satisfaction and improve conversion rates. Here are some key advantages of offering alternative payment methods:

1. Increased Customer Satisfaction: Different customers have different preferences when it comes to payment methods. By providing a variety of options, including digital wallets, bank transfers, and prepaid cards, merchants can cater to the diverse needs and preferences of their customer base. This flexibility leads to higher levels of customer satisfaction, as customers can choose the payment method that suits them best.

2. Improved Conversion Rates: The availability of alternative payment methods can have a direct impact on conversion rates. Some customers may not proceed with a purchase if their preferred payment option is not available. By offering a wide range of payment methods, merchants reduce the friction at checkout and increase the likelihood of completing a sale. This, in turn, leads to higher conversion rates and increased revenue.

3. Tap into New Markets: Offering alternative payment methods can help merchants tap into new customer segments. For example, mobile payment options like Apple Pay and Google Pay are popular among younger demographics who prefer using their smartphones for transactions. By embracing these technologies, merchants can attract and retain these potential customers.

4. Enhanced Security: Alternative payment methods often come with advanced security features. For instance, digital wallets utilize tokenization and biometric authentication to protect customer data. By offering these secure payment options, merchants build trust with their customers and protect sensitive information, reducing the risk of fraud and chargebacks.

5. Differentiation from Competitors: In a crowded online marketplace, offering alternative payment methods can differentiate a merchant from its competitors. By providing a seamless and diverse range of payment options, merchants can attract customers who prioritize convenience and flexibility in their shopping experience.

6. International Expansion: Alternative payment methods also enable merchants to expand their reach globally. Cross-border payment solutions and digital currencies make it easier for merchants to accept payments from customers in different countries, breaking down barriers and facilitating international transactions.

By embracing alternative payment methods, merchants can enhance customer satisfaction, improve conversion rates, tap into new markets, enhance security, differentiate from competitors, and expand internationally. The benefits of offering diverse payment options go beyond just convenience, providing a strategic advantage for merchants in the ever-evolving e-commerce landscape.

The Impact on Conversion Rates: Streamlining the Checkout Experience

Providing alternative payment methods can significantly impact conversion rates by streamlining the checkout experience for customers. By offering a diverse array of payment options, businesses can cater to the preferences and needs of their target audience, ultimately boosting customer satisfaction and driving more sales.

Convenience and Flexibility

Alternative payment methods, such as digital wallets, mobile payments, and buy now pay later (BNPL) services, offer customers a convenient and flexible way to complete their transactions. These methods eliminate the need for customers to manually enter their credit card information or undergo lengthy verification processes. Instead, customers can securely store their payment details within these platforms, allowing for quick and seamless checkouts with just a few clicks.

Speed and Efficiency

Traditional credit card payments often involve multiple steps, including entering card details, billing addresses, and security codes. This can lead to cart abandonment if customers find the process too time-consuming or cumbersome. In contrast, alternative payment methods streamline the checkout process, reducing friction and enhancing the overall shopping experience. Customers can complete their purchases more efficiently, resulting in higher conversion rates for businesses.

Enhanced Security

Another advantage of alternative payment methods is the added layer of security they offer. Many digital wallets and mobile payment apps utilize tokenization and encryption technologies to protect customer payment information. This reassures customers that their financial details are safe and reduces concerns about fraud or unauthorized access. By providing secure payment options, businesses can build trust with their customers and encourage more successful transactions.

Improved User Experience

Simplifying the checkout process through alternative payment methods contributes to an improved user experience. Customers appreciate businesses that offer seamless and hassle-free transactions. By incorporating alternative payment options into their e-commerce platforms, businesses not only enhance customer satisfaction but also encourage repeat purchases and greater customer loyalty.

In conclusion, alternative payment methods play a crucial role in streamlining the checkout experience and optimizing conversion rates. By embracing a diverse range of payment options, businesses can cater to customer preferences, minimize friction during the purchasing process, and enhance overall user satisfaction. Investing in alternative payment methods can ultimately lead to increased sales and sustainable growth in the competitive e-commerce landscape.

Security Considerations: Building Trust in Alternative Transactions

In the digital age, security is a paramount concern for both businesses and consumers. When it comes to alternative payment methods, addressing security considerations becomes crucial in building trust and confidence in these transactions. Here are some key measures that can ensure secure transactions for alternative payment methods:

Encryption and Data Protection

One of the fundamental security practices is the use of encryption to protect sensitive information. Implementing strong encryption algorithms helps safeguard data throughout the payment process, reducing the risk of unauthorized access or data breaches. Additionally, businesses must adopt robust data protection measures, including secure storage and transmission protocols, to further fortify their security posture.

Tokenization for Enhanced Security

Tokenization offers an extra layer of security for alternative payment methods. By substituting sensitive card or account details with unique tokens, businesses can minimize the exposure of confidential information. This practice prevents unauthorized access or potential theft of payment data, reducing the risk of fraudulent activity.

Compliance with Industry Standards

Adhering to industry standards ensures that businesses meet rigorous security requirements. Compliance certifications such as PCI DSS (Payment Card Industry Data Security Standard) demonstrate a commitment to protecting customer data. Working with reputable payment service providers who comply with these regulations can give both businesses and consumers peace of mind in their transactions.

Two-Factor Authentication

Implementing two-factor authentication (2FA) adds an extra layer of protection to alternative payment methods. By requiring users to provide two different forms of identification, such as a password and a verification code sent to their mobile device, businesses can significantly reduce the risk of unauthorized access or identity theft.

Regular Security Audits and Updates

Regular security audits and updates are vital to ensure the continued integrity of alternative payment systems. By conducting audits, businesses can identify vulnerabilities and address them promptly. Furthermore, staying up to date with the latest security patches and updates helps protect against newly identified threats and vulnerabilities.

Fraud Monitoring and Risk Assessment

Implementing robust fraud monitoring systems allows businesses to detect and respond to suspicious activity promptly. Investing in fraud prevention tools, such as machine learning algorithms and artificial intelligence, can help identify patterns and anomalies that indicate potential fraudulent transactions. Combined with risk assessment practices, businesses can effectively mitigate fraud risks associated with alternative payment methods.

Security should always be a top priority when offering alternative payment methods. By implementing these measures, businesses can build trust and confidence in their customers, ensuring secure transactions and fostering long-term relationships.

Industry-Specific Adoption: Tailoring Solutions to Business Needs

In today’s digital era, businesses across various industries are realizing the importance of offering alternative payment methods to cater to the unique needs of their customers. These industries have recognized that by embracing specific alternative payment methods, they can enhance the overall shopping experience and increase customer satisfaction. Let’s explore some of these industries and how they have successfully implemented tailored payment solutions.

Retail and E-commerce

The retail and e-commerce sector has experienced a significant shift in recent years, with a growing demand for diverse payment options. Retailers are now offering buy now pay later (BNPL) services, allowing customers to make purchases without the burden of immediate payment. This flexible payment solution has proven to be especially popular among younger consumers who prefer to spread out their payments and manage their finances effectively.

Travel and Hospitality

The travel and hospitality industry has also embraced alternative payment methods to enhance customer convenience and accessibility. With the rise of digital wallets like Apple Pay and Google Pay, travelers can now make contactless payments seamlessly, eliminating the need to carry physical cards or cash. These solutions not only simplify the payment process but also provide an added layer of security for customers.

Healthcare

The healthcare industry has been quick to adopt alternative payment methods to streamline their billing processes and provide greater convenience to patients. With the use of e-checks, patients can make digital payments for medical services, reducing paperwork and minimizing the need for manual payment processing. This has not only improved the overall patient experience but has also increased the efficiency of healthcare providers.

Subscription Services

Subscription-based businesses, such as streaming platforms and subscription boxes, have also recognized the importance of alternative payment methods in attracting and retaining customers. By offering a variety of payment options, such as direct debits or prepaid cards, these businesses can cater to a wider audience and ensure seamless recurring payments. This flexibility enhances customer satisfaction and encourages long-term subscriptions.

Gaming and Entertainment

The gaming and entertainment industry has witnessed a surge in alternative payment methods, particularly with the integration of cryptocurrencies. Gamers can now make in-game purchases using digital currencies like Bitcoin, providing a secure and anonymous method of payment. This approach not only adds convenience but also opens up new markets and attracts a global audience.

These are just a few examples of industries that have successfully adopted and tailored alternative payment solutions to their specific business needs. By understanding their target audience and keeping up with the latest trends in the payment landscape, businesses can enhance customer satisfaction, improve conversion rates, and stay competitive in the digital world.

Future Trends: Anticipating the Evolution of Alternative Payments

The world of e-commerce is constantly evolving, and alternative payment methods are no exception. As businesses strive to provide seamless and convenient payment experiences, it’s crucial to stay ahead of emerging trends. Here are some anticipated future trends in alternative payments:

1. Increased Adoption of Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is gaining traction as a secure and convenient way to authorize transactions. With advancements in technology and the widespread use of smartphones, biometric authentication is expected to play a significant role in alternative payment methods.

2. Integration of Voice-Activated Payments

Voice-activated assistants like Amazon’s Alexa and Apple’s Siri have become increasingly popular. As the technology matures, voice-activated payments are poised to become a mainstream feature. Users will be able to make purchases simply by using their voice, providing a seamless and hands-free payment experience.

3. Embracing Cryptocurrencies and Blockchain Technology

Cryptocurrencies, such as Bitcoin and Ethereum, have made a significant impact on the financial world. With increased acceptance and regulation, cryptocurrencies are expected to become more widely adopted as alternative payment methods. Blockchain technology, which underpins cryptocurrencies, offers enhanced security and transparency, further driving their popularity.

4. Artificial Intelligence (AI)-Powered Payment Solutions

AI has already revolutionized various industries, and the payment landscape is no exception. AI-powered payment solutions can offer personalized recommendations, fraud detection, and enhanced risk assessment, providing a smoother and more secure payment experience for customers.

5. Expansion of Mobile Payment Systems

Mobile payment systems like Apple Pay and Google Pay have gained significant traction in recent years. As the use of smartphones continues to rise, mobile payment systems will expand further, allowing customers to make purchases with just a tap on their mobile devices.

6. Innovative Cross-Border Payment Solutions

Global e-commerce transactions often face challenges related to currency conversion and high transaction fees. Innovative cross-border payment solutions are expected to emerge, providing cost-effective and efficient options for international payments, thereby overcoming these barriers.

7. Integration of Augmented Reality (AR) and Virtual Reality (VR)

AR and VR technologies have the potential to revolutionize the shopping experience. Imagine trying on clothes virtually or visualizing furniture in your home before making a purchase. Integrating AR and VR into alternative payment methods can enhance customer engagement and drive conversions.

As technology continues to advance and consumer preferences evolve, it’s crucial for businesses to adapt and embrace the evolving landscape of alternative payment methods. By staying aware of these future trends and leveraging the latest technological advancements, businesses can stay ahead of the curve and provide their customers with the best possible payment experience.

Conclusion: Embracing Diversity in Digital Transactions

In the ever-evolving landscape of e-commerce, it is crucial for businesses to adapt and offer a diverse range of payment options. By embracing alternative e-commerce payment methods beyond traditional credit cards and PayPal, businesses can cater to the changing preferences of their customers and expand their customer base.

The importance of offering various payment options cannot be overstated. Customers have different preferences when it comes to how they want to pay for their online purchases. Some prefer the convenience and security of digital wallets like Apple Pay and Google Pay, while others may opt for bank transfers or direct debits for a seamless checkout experience.

By catering to these diverse payment preferences, businesses can enhance customer satisfaction and loyalty. Providing alternative payment methods gives customers more flexibility and a sense of control over their transactions. This, in turn, leads to improved customer experiences and higher conversion rates.

Furthermore, embracing a wide range of payment options allows businesses to tap into new markets and cater to customers from different regions. Cross-border payment solutions and the acceptance of cryptocurrencies as alternative payment methods enable businesses to overcome currency barriers and unlock new opportunities for growth.

In conclusion, the e-commerce landscape is rapidly evolving, and embracing diversity in payment options is essential for businesses to thrive. By offering a variety of alternative payment methods, businesses can meet the evolving needs of their customers, enhance their customer satisfaction, and stay ahead in the competitive world of digital transactions.