Are you ready to tap into the growing trend of mobile payments and take your business to the next level? In today’s fast-paced world, where convenience is key, mobile payments have emerged as a game-changer for businesses of all sizes. By leveraging this technology, you can streamline transactions, improve customer satisfaction, and stay ahead of the competition.

With the widespread adoption of mobile devices and the increasing preference for digital transactions, mobile payments have become an essential part of the modern business landscape. But what exactly are mobile payments, and how can they benefit your business?

In this comprehensive blog, we will delve into the convenience of mobile payments and explore how businesses can leverage this trend to enhance their financial well-being. From the impact of mobile payment infrastructure on small businesses to the revolutionizing consumer experience and profitability strategies, we will cover it all. Stay tuned to discover the top payment trends to watch out for in the future and unlock the full potential of mobile payments for your business.

Impact of Mobile Payment Infrastructure on Small Businesses

With the increasing popularity of mobile payments, small businesses are presented with new opportunities to enhance their financial security, streamline transactions, and provide a more convenient experience for their customers. The adoption of mobile payment infrastructure has revolutionized the way businesses handle financial transactions, offering a wide range of benefits and advantages.

Enhancing Financial Security and Fraud Protection for Small Businesses

One of the key advantages of mobile payment infrastructure for small businesses is the enhanced financial security and fraud protection it provides. By utilizing advanced encryption technology and secure payment gateways, businesses can minimize the risk of fraudulent transactions and protect sensitive customer information. This not only builds trust with customers but also safeguards the financial well-being of the business itself.

Increased Efficiency and Convenience for Small Businesses

Mobile payment infrastructure offers small businesses increased efficiency and convenience in processing transactions. By accepting mobile payments, businesses can eliminate the need for traditional payment methods such as cash or checks, reducing the time spent on manual processing and improving overall operational efficiency. Additionally, mobile payments enable businesses to offer various payment options, including contactless payments and mobile wallets, catering to the preferences of a wide range of customers.

Adapting to Changing Consumer Behavior: How Mobile Payment Infrastructure Benefits Small Businesses

The adoption of mobile payment infrastructure allows small businesses to adapt to changing consumer behavior and meet the evolving needs of their customers. With the increasing popularity of mobile payments among consumers, businesses that embrace this technology can provide a seamless and convenient payment experience, ultimately enhancing customer satisfaction and attracting a wider customer base. By staying ahead of the curve and embracing the convenience of mobile payments, small businesses can position themselves for long-term success.

In conclusion, the impact of mobile payment infrastructure on small businesses is significant. From enhancing financial security and fraud protection to increasing efficiency and adapting to changing consumer behavior, mobile payments offer a unique opportunity for small businesses to streamline transactions and improve their overall financial well-being.

Enhancing Financial Security and Fraud Protection for Small Businesses via Mobile Payments

Mobile payment infrastructure offers numerous benefits for small businesses, including enhanced financial security and fraud protection. By utilizing mobile payment technologies, small businesses can mitigate the risk of fraudulent transactions and safeguard their financial well-being. Here’s how mobile payments can help enhance financial security and protect against fraud.

1. Secure Payment Processing Solutions

Mobile payment providers offer secure payment processing solutions specifically designed to protect sensitive financial information. These solutions employ encryption and tokenization techniques to secure payment data, making it extremely difficult for hackers to intercept or manipulate transaction data.

2. Two-Factor Authentication

Mobile payment apps and platforms often utilize two-factor authentication methods, adding an extra layer of security to the transaction process. Two-factor authentication requires users to provide additional verification, such as a fingerprint scan or a unique PIN, ensuring that only authorized individuals can complete transactions.

3. Fraud Detection and Prevention Tools

Mobile payment infrastructure incorporates advanced fraud detection and prevention tools that actively monitor and analyze transaction data. These tools can identify suspicious patterns and behaviors, such as unusual spending patterns or multiple failed authentication attempts, helping businesses detect and mitigate potential fraud.

4. EMV Chip Technology

Many mobile payment solutions support EMV chip technology, which provides an added level of security compared to traditional magnetic stripe cards. EMV chips generate unique transaction codes for each payment, making it virtually impossible for fraudsters to replicate or reuse transaction information.

5. Real-Time Transaction Monitoring

Mobile payment platforms offer real-time transaction monitoring, allowing businesses to track and review every transaction as it occurs. This real-time visibility enables quick identification of any unauthorized or suspicious activity, helping businesses take immediate action to prevent financial losses.

By embracing mobile payment infrastructure, small businesses can enhance their financial security and protect against fraud. These technologies offer secure payment processing solutions, two-factor authentication, fraud detection tools, EMV chip technology, and real-time transaction monitoring. Implementing these measures helps businesses build customer trust, safeguard their financial well-being, and foster long-term success in the digital payment landscape.

Increased Efficiency and Convenience for Small Businesses with Mobile Payment Infrastructure

In today’s fast-paced digital age, small businesses need to keep up with evolving consumer expectations and preferences. Mobile payment infrastructure offers a valuable solution by enhancing the efficiency and convenience of financial transactions for small businesses. Here are some ways in which mobile payment technology revolutionizes the way small businesses operate:

1. Faster Checkouts: With mobile payment solutions, customers can complete transactions quickly and efficiently. Gone are the days of waiting in long queues or dealing with cumbersome cash transactions. Small businesses can now offer seamless and hassle-free checkout experiences, reducing customer waiting times and improving overall satisfaction.

2. Increased Sales Opportunities: Mobile payment infrastructure opens up new sales channels for small businesses. By accepting mobile payments, they can tap into the growing market of customers who prefer digital payment methods. This expands their customer base and presents opportunities for increased sales and revenue.

3. Streamlined Bookkeeping: The integration of mobile payment systems with accounting software simplifies the bookkeeping process for small businesses. Transactions are automatically recorded and categorized, reducing the time spent on manual data entry. This not only saves valuable time but also minimizes the risk of human error.

4. Cost Savings: Mobile payment infrastructure eliminates the need for bulky cash registers and manual processing of checks or credit cards. Small businesses can reduce hardware and administrative costs associated with traditional payment methods. Moreover, mobile payment solutions often come at a lower processing fee compared to traditional card payment processors, resulting in overall cost savings.

5. Enhanced Mobility: Mobile payment solutions enable small businesses to accept payments wherever they are, providing flexibility and convenience. Whether at a trade show, pop-up shop, or customer’s doorstep, businesses can effortlessly process payments on the go, eliminating the need for a fixed physical location.

In conclusion, embracing mobile payment infrastructure empowers small businesses to operate more efficiently, improve customer experiences, and adapt to changing consumer behavior. By integrating mobile payment solutions, small businesses can streamline transactions, reduce costs, and stay ahead of the competition in today’s digital landscape.

Adapting to Changing Consumer Behavior: How Mobile Payment Infrastructure Benefits Small Businesses

In today’s fast-paced digital world, consumer behavior is constantly evolving. As a small business owner, it’s crucial to not only keep up with these changes but also leverage them to your advantage. This is where mobile payment infrastructure comes into play, offering a range of benefits that can help your business adapt, thrive, and meet the evolving needs of your customers.

Convenience and Efficiency at Your Fingertips

Mobile payment infrastructure provides small businesses with the tools they need to streamline transactions and enhance customer experience. By accepting mobile payments, you can offer your customers a convenient and efficient way to make purchases. With just a few taps on their smartphones, they can complete transactions, eliminating the need for cash or physical credit cards.

Meeting Consumer Expectations

Consumers today expect businesses to offer modern and hassle-free payment options. By implementing mobile payment infrastructure, you can meet these expectations and create a seamless buying experience. Customers no longer have to fumble for their wallets or wait in long lines. Mobile payments enable quick and contactless transactions, making it easier for customers to make purchases on the spot.

Staying Ahead of the Competition

As more and more businesses adopt mobile payment infrastructure, it’s essential to stay ahead of the competition. By embracing this technology, you demonstrate your willingness to adapt to changing consumer behavior and provide the latest conveniences. This can give you a competitive edge and attract tech-savvy customers who prioritize streamlined and hassle-free transactions.

Enhanced Data and Insights

Mobile payment infrastructure also provides small businesses with valuable data and insights. By analyzing customer payment patterns and preferences, you can gain a deeper understanding of your target market. This information can help you tailor your marketing strategies, optimize your product offerings, and ultimately drive customer satisfaction and loyalty.

In conclusion, mobile payment infrastructure enables small businesses to adapt to changing consumer behavior by providing convenience, efficiency, and meeting customer expectations. By embracing this technology, you can stay ahead of the competition, enhance the customer experience, and gain valuable insights that will drive the success of your business.

How Mobile Payments Are Revolutionizing The Consumer Experience

Mobile payments have revolutionized the way consumers interact with businesses, offering a seamless and convenient experience that transforms traditional transactions. Here, we explore the key ways in which mobile payments are reshaping the consumer experience, from creating new opportunities for cross-selling and upselling to providing time-saving benefits and enhanced financial inclusion and security.

New Opportunities for Cross-Selling and Upselling

Mobile payments have opened up a world of possibilities for businesses to increase revenue by cross-selling and upselling products or services. With mobile payment technology, businesses can leverage real-time data to personalize the purchasing journey and offer targeted recommendations based on previous purchases or browsing history. This creates a more tailored and engaging experience for customers, increasing the chances of additional sales and customer loyalty.

Time-saving Benefits of Mobile Payments

One of the significant advantages of mobile payments is the time-saving benefits they offer both consumers and businesses. With contactless payment options and seamless integration with mobile wallets, customers can make quick and efficient transactions, eliminating the need for cash or physical credit cards. This not only reduces checkout times but also enhances the overall shopping experience, leading to greater customer satisfaction.

Improved Financial Inclusion and Security

Mobile payment technology plays a vital role in enhancing financial inclusion and security for consumers. It provides access to financial services for those who may have been previously underserved, allowing them to participate in the digital economy. Moreover, mobile payments offer advanced security features such as encryption, tokenization, and biometric authentication, ensuring secure transactions and protecting sensitive financial information.

As mobile payments continue to gain popularity, businesses must recognize the transformative impact they have on the consumer experience. By embracing this technology, businesses can unlock new opportunities for revenue growth, provide time-saving benefits, and contribute to financial inclusion and security for their customers. Stay ahead of the competition and tap into the convenience and advantages offered by mobile payments to create a truly satisfying consumer experience.

New Opportunities for Cross-Selling and Upselling

The adoption of mobile payment solutions by businesses opens up exciting opportunities for cross-selling and upselling products or services. Leveraging mobile payments allows businesses to enhance the customer experience and increase revenue by strategically promoting additional offerings.

Enhancing Customer Journey

Mobile payment technologies enable businesses to gather valuable customer data and insights. By analyzing customer preferences, purchase history, and behavior, businesses can personalize the shopping experience and offer relevant recommendations. For example, a retail store using mobile payments can track a customer’s buying habits and suggest complementary items during the checkout process, increasing the likelihood of cross-selling.

Targeted Promotions and Discounts

Mobile payment platforms provide a convenient way to deliver targeted promotions and discounts directly to customers’ mobile devices. By offering exclusive deals based on a customer’s previous purchases, businesses can encourage them to explore related products or services. For instance, a restaurant can send personalized offers to customers who have previously ordered a particular dish, promoting other menu items or special promotions.

Streamlined Loyalty Programs

Integrating mobile payment solutions with loyalty programs can further incentivize customers to make additional purchases. Businesses can offer rewards, discounts, or exclusive perks to customers who utilize mobile payments. This strategy not only promotes engagement and customer retention but also creates opportunities to showcase complementary products. For example, a coffee shop can reward customers with mobile payment-based loyalty points, which can be redeemed for free pastries or upgraded beverage options.

Innovative Product Bundles

Mobile payments enable businesses to create innovative product bundles, encouraging customers to explore complementary offerings. By packaging related products or services together at a discounted price, businesses can enhance the perceived value and drive upselling opportunities. For instance, a technology retailer can offer a bundle combination of a smartphone and compatible accessories during the mobile payment checkout process.

In conclusion, mobile payments provide businesses with new avenues for cross-selling and upselling. By personalizing the customer journey, offering targeted promotions, streamlining loyalty programs, and creating innovative product bundles, businesses can tap into the full potential of mobile payment solutions to maximize revenue and enhance the overall customer experience.

Time-saving Benefits of Mobile Payments

In today’s fast-paced world, time is of the essence. That’s why more and more customers are turning to mobile payments as a convenient and efficient way to complete their transactions. With the advent of mobile payment technology, customers no longer have to fumble for cash or wait in long lines to make a purchase. Here are some of the time-saving benefits that mobile payments offer:

1. Quick and Contactless Transactions

Mobile payments enable customers to make purchases with just a few taps on their smartphones or other mobile devices. By simply linking their credit or debit cards to mobile payment apps or digital wallets, customers can securely and conveniently complete transactions without needing to handle physical cards or currencies. This eliminates the time-consuming process of searching for the right amount of cash or swiping and signing with a card machine.

2. Seamless Online Shopping Experience

In addition to in-store transactions, mobile payments also streamline the online shopping experience. With mobile wallets integrated into e-commerce platforms, customers can securely store their payment information and make purchases with just a few clicks. This eliminates the need to repeatedly enter credit card details and shipping addresses, saving valuable time during the checkout process.

3. Instantaneous Fund Transfers

Mobile payment apps also allow for seamless fund transfers between individuals, eliminating the need for traditional methods like writing checks or waiting for bank transfers to clear. With just a few taps, customers can easily send money to friends or family, split bills, or reimburse others for shared expenses. This instant transfer of funds saves time and ensures that transactions are completed promptly.

4. Convenient Account Management

Mobile payment apps provide customers with easy access to their transaction history, account balances, and receipts, allowing them to manage their finances on the go. Whether it’s checking the status of a recent purchase or reviewing past transactions, customers can quickly and conveniently access all the information they need without the hassle of logging into separate banking or credit card websites.

Conclusion

Mobile payments offer numerous time-saving benefits for customers, simplifying the transaction process and enhancing overall convenience. With the ability to make quick and contactless transactions, seamless online shopping experiences, instantaneous fund transfers, and convenient account management, mobile payments provide an efficient and time-efficient solution for customers in today’s digital age.

Remember, embracing mobile payments not only benefits customers but can also lead to increased customer satisfaction, streamlined operations, and improved financial well-being for businesses.

Improved Financial Inclusion and Security

Mobile payment technology has brought significant advancements in terms of financial inclusion and security for customers. With the widespread adoption of mobile payment solutions, individuals who were previously excluded from traditional banking services now have access to a wide range of financial transactions.

Expanding Financial Inclusion

Mobile payments have opened doors for individuals who have limited access to traditional banking services. Through mobile wallets and payment apps, people can conveniently make transactions, send or receive money, and even access basic financial services without the need for a traditional bank account. This empowers them to participate in the digital economy and manage their financial activities more efficiently.

Enhanced Security Measures

Mobile payment technology has implemented robust security measures to protect customers’ financial transactions. Encryption techniques and secure authentication methods ensure that sensitive information, such as credit card details or personal identification, is safeguarded during the payment process. With mobile payments, customers can feel confident about the security of their financial data, reducing the risk of fraudulent activities and identity theft.

Convenience and Ease of Use

In addition to financial inclusion and security, mobile payments offer a convenient and user-friendly experience for customers. With just a few taps on their mobile devices, they can complete transactions anytime, anywhere. It eliminates the need to carry physical wallets or cards, reducing the risk of loss or theft. Moreover, the versatility of mobile payment solutions allows customers to choose from various payment channels, including contactless payments, mobile wallets, and digital payment platforms, to suit their preferences and needs.

Leveraging Loyalty Programs

Mobile payment technology has also revolutionized loyalty programs, offering customers added benefits and rewards for their transactions. By integrating loyalty programs directly into mobile payment apps, businesses can incentivize customer engagement, drive repeat purchases, and strengthen customer loyalty.

In conclusion, mobile payment technology has not only improved financial inclusion by providing access to financial services for underserved communities but has also enhanced security measures to protect customers’ sensitive information. Additionally, the convenience and ease of use offered by mobile payments have transformed the way customers engage in financial transactions while leveraging loyalty programs for added benefits. Embracing mobile payments unlocks a unique opportunity for businesses to tap into a wider customer base and improve the financial well-being of their operations.

Unlocking Profitability — Mastering Mobile Payments for Business Success!

As businesses strive to stay ahead in today’s digital landscape, mobile payments have emerged as a game-changer. With their potential to streamline transactions and improve financial well-being, mastering mobile payments is crucial for unlocking profitability. In this section, we will explore reliable and secure payment processing solutions, eCheck payment solutions, and merchant services as key components of successful mobile payment integration. Additionally, we will discuss the importance of embracing a variety of mobile payment options and optimizing the user experience to enhance customer satisfaction.

Reliable And Secure Payment Processing Solutions, eCheck Payment Solutions, and Merchant Services

To maximize profitability through mobile payments, businesses need reliable and secure payment processing solutions. By partnering with trusted financial service organizations, businesses can ensure seamless and secure transactions, safeguarding customer data and mitigating the risk of fraud. Implementing eCheck payment solutions further expands payment options, accommodating customers who prefer electronic bank transfers. This enhances convenience and broadens the potential customer base.

Merchant services play a critical role in enabling businesses to accept mobile payments. These services provide businesses with the necessary infrastructure to process and manage payment transactions efficiently. By working with reputable payment service providers, businesses gain access to secure payment channels and advanced fraud detection measures, instilling confidence in customers and reducing the risk of financial loss.

Embrace a Variety of Mobile Payment Options

Businesses that embrace a variety of mobile payment options cater to the diverse preferences of their customers. From contactless payments using mobile wallets to tap-to-pay options with contactless credit cards, offering multiple options enables customers to choose the method that aligns with their lifestyle and preferences. This flexibility creates a positive customer experience and encourages repeat business.

By leveraging loyalty programs in mobile payment solutions, businesses can incentivize customer loyalty and drive repeat purchases. Integrated loyalty programs not only enhance the overall customer experience but also open up opportunities for cross-selling and upselling additional products or services.

Optimize the User Experience

An optimized user experience is crucial for business success in the mobile payments landscape. Simplifying the payment process and ensuring a seamless, intuitive interface will minimize customer friction and increase the likelihood of completed transactions. By prioritizing user-centric design, businesses can enhance customer satisfaction and establish themselves as leaders in the mobile payment space.

In conclusion, unlocking profitability through mastering mobile payments requires businesses to leverage reliable and secure payment processing solutions, embrace a variety of mobile payment options, and optimize the user experience. By staying ahead of the evolving mobile payments landscape, businesses can tap into new revenue streams, build customer loyalty, and drive business success.

Reliable And Secure Payment Processing Solutions, eCheck Payment Solutions, and Merchant Services

In today’s digital landscape, businesses need reliable and secure payment processing solutions to streamline transactions and ensure customer satisfaction. Let’s explore some of the options available for businesses seeking efficient and secure payment solutions.

1. Payment Processing Solutions

Payment processing solutions are essential for businesses to accept various forms of payment, including mobile payments. Reliable payment processors offer secure transaction processing that meets industry standards for data encryption and protection. By partnering with a trusted payment processor, businesses can ensure that customer financial information is handled securely, minimizing the risk of data breaches and fraud.

2. eCheck Payment Solutions

eCheck payment solutions provide businesses with a convenient way to accept electronic checks as a payment method. Unlike traditional checks, eChecks can be processed digitally, saving businesses time and resources. Additionally, eChecks offer secure transactions and reduce the risk of bounced checks. With eCheck payment solutions, businesses can expand their customer base by catering to those who prefer alternative payment methods.

3. Merchant Services

Merchant services encompass a range of financial services provided to businesses, including payment gateway integration, point-of-sale systems, and online payment processing. These services help businesses facilitate transactions securely and efficiently. By utilizing merchant services, businesses can enhance the customer experience and improve their bottom line.

4. Ensuring Security Measures

When selecting payment processing solutions, businesses must prioritize security. Look for features such as tokenization, which replaces sensitive card data with unique tokens, and fraud detection systems that monitor transactions for suspicious activity. Additionally, choosing a payment processor that is PCI DSS compliant ensures adherence to stringent security standards.

Implementing reliable and secure payment processing solutions, eCheck payment solutions, and merchant services is crucial for businesses looking to stay ahead in the digital payment landscape. By leveraging these technologies, businesses can enhance customer trust, expand their customer base, and optimize their financial well-being.

Embrace a Variety of Mobile Payment Options

In today’s fast-paced digital landscape, it’s crucial for small businesses to embrace a variety of mobile payment options to cater to the diverse preferences and needs of their customers. By doing so, businesses can provide a seamless and convenient payment experience that enhances customer satisfaction and drives sales.

Here are some reasons why embracing a variety of mobile payment options is essential:

1. Catering to different customer preferences: Not all customers have the same preferred payment method. Some may prefer using mobile wallets like Apple Pay or Google Pay, while others may prefer contactless credit cards or payment apps. By offering a range of options, businesses can accommodate various customer preferences and increase the likelihood of completing a sale.

2. Expanding customer base: Embracing a variety of mobile payment options allows businesses to tap into a wider customer base. In today’s digital age, many consumers rely on mobile payments for their daily transactions. By providing the payment channels they prefer, businesses can attract new customers and retain existing ones.

3. Keeping up with the latest trends: The payments industry is constantly evolving, with new technologies and methods emerging regularly. By embracing a variety of mobile payment options, businesses demonstrate their adaptability and willingness to stay current with trends. This positions them as forward-thinking and customer-centric, instilling trust and confidence in their brand.

4. Enhancing security and trust: Mobile payment options often come with advanced security features and encryption protocols, offering a secure transaction experience for both businesses and customers. By embracing these options, businesses can assure their customers that their financial information is protected, fostering a sense of trust and encouraging repeat business.

To effectively embrace a variety of mobile payment options, businesses should research and integrate payment processors, digital wallets, and contactless credit card terminals that align with their specific needs. By offering a range of choices, businesses can streamline the integration process and ensure they are catering to the diverse preferences of their customer base.

Remember, providing a variety of mobile payment options is a key strategy for staying competitive in today’s digital landscape. By embracing this approach, businesses can enhance the convenience and satisfaction of their customers, ultimately driving growth and success.

Optimize the User Experience

To truly harness the power of mobile payments and maximize customer satisfaction, businesses must prioritize optimizing the user experience. By ensuring a seamless and intuitive mobile payment journey, businesses can build trust, encourage repeat business, and attract new customers. Here are some key strategies to optimize the user experience for mobile payments:

Streamlined Checkout Process

Simplify the mobile payment process by minimizing the number of steps required to complete a transaction. Implementing a one-click or autofill feature can significantly reduce friction and make the checkout process quick and hassle-free. By eliminating unnecessary hurdles, businesses can enhance the overall user experience and increase conversion rates.

Intuitive Mobile Wallet Integration

Integrate popular mobile wallet platforms, such as Apple Pay or Google Pay, into your business’s payment options. This allows customers to store their payment information securely and easily access it when making purchases. By supporting widely used mobile wallets, businesses provide a convenient and familiar payment method, resulting in a smoother checkout experience.

Responsive Design for Mobile Devices

Optimize your website and payment interface for mobile devices to ensure a seamless experience across all screen sizes. Use a responsive design that adapts to different mobile screens, making it easy for customers to navigate and complete transactions. Remember, a mobile-friendly design is crucial for enhancing user experience and driving engagement.

Personalized and Targeted Offers

Leverage customer data to personalize mobile payment experiences. By analyzing customer purchase history and behaviors, businesses can offer targeted promotions or discounts through mobile payment apps. This tailored approach enhances the user experience by providing relevant offers that cater to individual preferences, ultimately boosting customer satisfaction and loyalty.

Robust Security Measures

One of the primary concerns for customers using mobile payments is security. Implement strong security measures, such as encryption and tokenization, to protect sensitive customer information. Clearly communicate your commitment to data security to instill confidence in customers and alleviate any concerns they may have regarding the safety of their transactions.

Optimizing the user experience for mobile payments is a crucial step in ensuring customer satisfaction and driving business growth. By streamlining the checkout process, integrating mobile wallets, prioritizing responsive design, offering personalized promotions, and implementing robust security measures, businesses can create a seamless and enjoyable mobile payment experience for their customers. Remember, a positive user experience leads to increased customer satisfaction, loyalty, and ultimately, business success.

Mobile payments: Definition, history & trends for 2023

Mobile payments have become increasingly prevalent in recent years, revolutionizing the way we conduct financial transactions. In this section, we will explore the definition of mobile payments, delve into their history, and discuss the key trends to watch for in 2023.

Introduction to Mobile Payments

Mobile payments, also known as m-payments, refer to financial transactions conducted through a mobile device, such as a smartphone or tablet. They provide a convenient and secure alternative to traditional payment methods, allowing users to make purchases, transfer money, and pay for goods and services using their mobile devices.

The concept of mobile payments first gained traction in the early 2000s with the introduction of mobile wallets and contactless payment technology. Companies like Apple and Google have played a significant role in popularizing mobile payment solutions such as Apple Pay and Google Pay, respectively.

How Do Mobile Payments Work?

Mobile payments leverage near field communication (NFC) technology or mobile apps to facilitate transactions. NFC enables contactless communication between devices, allowing users to simply tap their mobile device on a compatible payment terminal to complete a transaction. Mobile payment apps, on the other hand, securely store users’ payment information and facilitate transactions through encrypted connections.

Mobile Payment Trends to Watch in 2023

As we look ahead to 2023, several trends are poised to shape the mobile payment landscape. Here are some key trends to watch for:

1. Continued Growth and Widespread Adoption: Mobile payments are expected to continue their growth trajectory, with an increasing number of businesses and consumers embracing this technology.

2. Enhanced Security Features: As mobile payments become more prevalent, security measures will evolve to ensure the protection of users’ financial information, such as biometric authentication and tokenization.

3. Integration with Loyalty Programs: Mobile payment solutions are increasingly integrating loyalty programs, allowing businesses to leverage customer data and provide personalized offers and incentives.

4. Expansion of Contactless Payments: Contactless payment methods, which enable quick and secure transactions without physical contact, will become more widespread, especially in the wake of the COVID-19 pandemic.

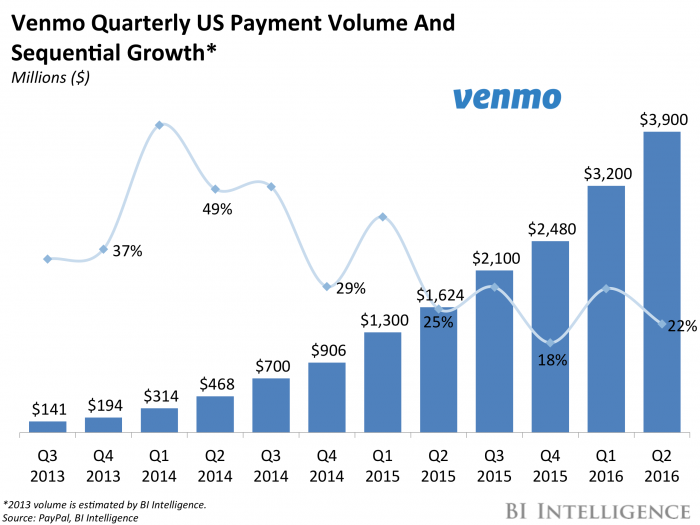

5. Continued Rise of P2P Payments: Peer-to-peer (P2P) payment platforms like Venmo and PayPal will continue to gain popularity, offering convenient ways for individuals to send and receive money.

By staying informed about these trends and adopting mobile payment solutions that align with their business needs, entrepreneurs and business owners can leverage the full potential of mobile payments in 2023 and beyond.

Introduction to Mobile Payments

In today’s digital landscape, mobile payments have emerged as a significant game-changer, revolutionizing the way we make transactions. With the increasing popularity and convenience of mobile devices, businesses and consumers alike are embracing this digital payment method. But what exactly are mobile payments, and why are they so significant?

Mobile payments refer to the process of using a mobile device to facilitate financial transactions. Whether it’s a smartphone, tablet, or wearable device, these devices enable users to make payments securely and conveniently, without the need for physical cash or traditional payment methods like credit cards.

Mobile payments offer numerous benefits for both businesses and consumers. For businesses, mobile payments provide a versatile and user-friendly payment channel that can cater to the needs of a wide customer base. By accepting mobile payments, businesses can streamline their integration with various payment processing solutions and leverage loyalty programs to drive customer satisfaction and loyalty.

For consumers, mobile payments offer convenience and security. With a mobile wallet such as Apple Pay or a contactless payment method, customers can make payments by simply tapping their devices at the point of sale. This minimizes the need to carry physical cards and speeds up the payment process. Furthermore, mobile payment solutions often incorporate security features such as fingerprint or facial recognition, adding an extra layer of protection for financial transactions.

The growth rate of mobile payment transactions has seen a significant increase in recent years, driven by the widespread adoption of mobile payment apps and the rise of mobile commerce. As a result, businesses that embrace mobile payments unlock a unique opportunity to tap into a wider customer base and improve their financial well-being.

Overall, mobile payments have become an integral part of the business landscape, offering businesses and consumers a convenient, secure, and efficient way to handle financial transactions. In the following sections, we will delve deeper into how mobile payment infrastructure can benefit small businesses, how it revolutionizes the consumer experience, and the latest trends in mobile payments to watch out for.

How Do Mobile Payments Work?

Mobile payments have revolutionized the way we conduct financial transactions, providing a convenient and secure alternative to traditional payment methods. The process of mobile payments involves several steps, utilizing innovative technology to facilitate seamless transactions. Here’s a breakdown of how mobile payments work and the underlying technology behind them:

1. Mobile Wallet Setup

– Users need to download a mobile payment app or register for a mobile wallet service provided by their financial institution.

– They can link their accounts, such as credit cards, debit cards, or bank accounts, to their mobile wallet for easy payment access.

2. Authentication and Security

– To ensure secure transactions, mobile payment systems implement various security measures, including encryption and tokenization.

– Users may need to set up additional authentication methods, such as PINs, passwords, fingerprints, or facial recognition, to authorize payments.

3. Payment Initialization

– Customers can initiate mobile payments by tapping or scanning their mobile devices at payment terminals equipped with near-field communication (NFC) technology.

– NFC enables contactless communication between the mobile device and the payment terminal, securely transmitting payment information.

4. Transaction Processing

– Once the payment is initiated, the mobile payment app or wallet securely transmits the encrypted payment data to the payment processor or acquirer.

– The payment processor verifies the transaction details, checks for available funds, and communicates with the card networks and financial institutions involved.

5. Authorization and Settlement

– The payment processor sends an authorization request to the customer’s financial institution to confirm the transaction’s authenticity and ensure funds availability.

– If authorized, the financial institution sends an approval response back through the payment processor.

– The payment processor communicates the approval response to the merchant’s payment terminal, allowing the transaction to proceed.

6. Confirmation and Receipt

– Both the customer and merchant receive confirmation of the successful transaction.

– Merchants can provide e-receipts to customers through mobile payment apps or email, reducing the need for paper receipts.

Mobile payments leverage the versatility of mobile devices, integrating various technologies like NFC, secure encryption, and authentication methods to enable seamless and secure transactions. By understanding the process and technology behind mobile payments, businesses can harness this innovative payment method to enhance customer experiences and drive growth in the increasingly digital landscape.

Remember, the wide range of mobile payment options available today empowers businesses to cater to different customer preferences and tap into the growing popularity of mobile payments while ensuring secure transactions and providing a simplified payment experience.

Mobile Payment Trends to Watch in 2023

As technology continues to evolve, so does the landscape of mobile payments. In 2023, several emerging trends are set to shape the future of mobile payments and transform the way businesses and consumers carry out financial transactions. These trends hold immense potential for businesses to tap into and stay ahead of the competition. Let’s explore some of the key trends that will dominate the mobile payment industry in 2023:

1. Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is becoming increasingly prevalent in mobile payments. This advanced security measure adds an extra layer of protection, reducing fraud risks and ensuring secure transactions. With the rise of biometric technology, customers can enjoy a seamless and secure payment experience, eliminating the need for passwords or PINs.

2. Contactless Payments

Contactless payments have gained significant popularity in recent years, and this trend is set to continue in 2023. With the widespread adoption of mobile wallets and the increasing use of contactless credit cards, customers can make swift and convenient payments by simply tapping their mobile devices or cards on contactless payment terminals. This trend not only enhances customer satisfaction but also accelerates transaction speeds, benefiting both businesses and consumers.

3. Peer-to-Peer (P2P) Payments

P2P payments have revolutionized the way individuals transfer money to friends, family, or colleagues. In 2023, the rise of P2P payment apps and platforms will continue to shape the mobile payment landscape. These services offer seamless fund transfers, splitting bills, and even social payments, allowing users to send and receive money with ease.

4. Integration of Loyalty Programs

Mobile payment solutions are increasingly integrating loyalty programs to provide users with a more personalized and rewarding experience. By leveraging loyalty programs within mobile payment apps, businesses can drive customer engagement, encourage repeat purchases, and foster brand loyalty. This integration offers a unique opportunity for businesses to enhance customer relationships and boost their bottom line.

5. Enhanced Security Features

As the mobile payment industry grows, so do the security measures to protect sensitive user information. In 2023, we can expect heightened security features, including tokenization, encryption, and real-time fraud detection. These advancements provide businesses and consumers with peace of mind, ensuring secure and worry-free transactions.

In conclusion, mobile payment trends for 2023 are set to advance the payment ecosystem, offering businesses opportunities to streamline transactions, enhance security, and cater to the evolving needs of consumers. By keeping an eye on these trends and embracing the latest technologies, businesses can position themselves at the forefront of the mobile payment revolution and leverage its benefits for greater success.

Top 7 Payment Trends to Watch in 2024 and Beyond

In this ever-evolving digital landscape, staying up-to-date with the latest payment trends is crucial for businesses to thrive. Here are the top seven payment trends that will shape the future of transactions:

Background on the Payments Industry

To understand where the payments industry is headed, it’s essential to grasp its evolution. The landscape has significantly shifted from traditional payment methods to digital platforms, driven by technological advancements and changing consumer preferences.

Going Cashless Leads the Way for Digital Payment Trends

The trend of going cashless is gaining traction worldwide. With the convenience and ease of digital payments, consumers are increasingly opting for contactless transactions using their mobile devices or payment apps. As businesses embrace this cashless revolution, adopting digital payment infrastructure becomes crucial for long-term success.

Paving the Way for More P2P Payments

Peer-to-peer (P2P) payments have become increasingly popular, enabling individuals to transfer funds directly to each other without intermediaries. This trend not only simplifies transactions but also opens new avenues for businesses to tap into this growing segment by integrating P2P payment functionalities.

By leveraging loyalty programs and offering customer-centric payment solutions, businesses can enhance customer experiences and drive engagement.

Embracing Cryptocurrencies and Blockchain Technology

Cryptocurrencies and blockchain technology have gained momentum in recent years. As more businesses and consumers realize the benefits of decentralization and security offered by cryptocurrencies, integrating digital currencies into their payment ecosystem can expand their customer base and provide a unique value proposition.

Biometric Authentication for Enhanced Security

Biometric authentication methods, such as fingerprint or facial recognition, provide an extra layer of security for payment transactions. By incorporating biometric authentication into their payment systems, businesses can ensure secure transactions and foster customer trust.

Integrating Internet of Things (IoT) in Payments

The Internet of Things (IoT) encompasses a network of interconnected devices that can exchange data. Integrating IoT in payments allows businesses to offer innovative and seamless payment experiences. For example, smart devices can facilitate automatic and frictionless payments, enhancing convenience for customers.

Enhancing Payment Data Analytics

Payment data analytics provides valuable insights into customer behavior and preferences. By harnessing this data, businesses can tailor their offerings, optimize pricing strategies, and enhance customer satisfaction. Implementing robust payment data analytics tools will become increasingly important for businesses to navigate the evolving payment landscape.

The world of payments is evolving rapidly, and businesses must stay ahead by embracing these emerging trends. By adapting to new technologies and consumer preferences, businesses can streamline transactions, improve customer experiences, and position themselves for long-term success in the digital era.

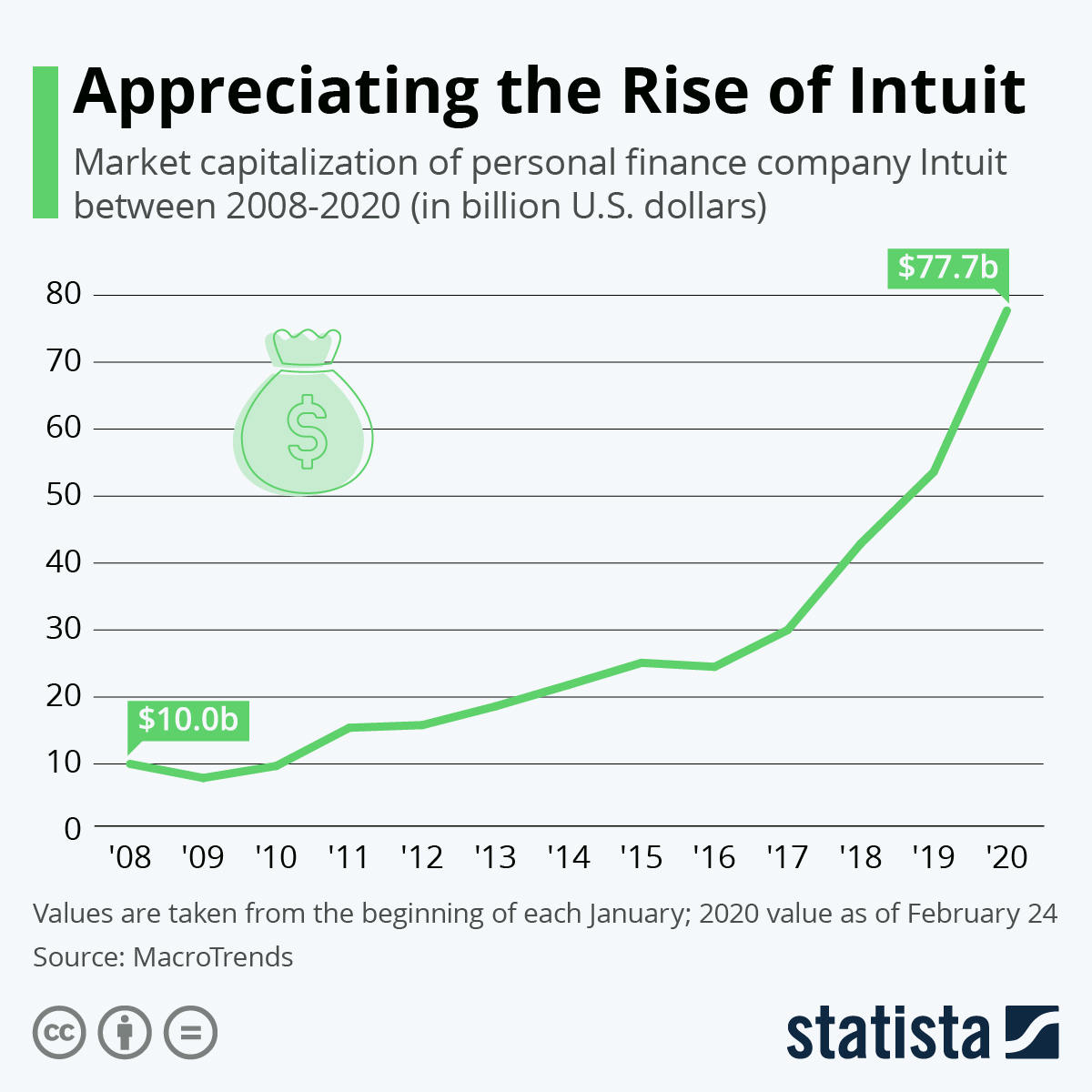

Background on the Payments Industry

The payments industry has witnessed significant transformation over the years, with the advent of technology and shifting consumer preferences. From traditional cash transactions to digital payments, the landscape has evolved to provide more convenience and efficiency for both businesses and consumers.

Rise of Digital Payments

The rise of digital payments has been fueled by the widespread adoption of mobile devices and the growing popularity of mobile payment solutions. With the introduction of mobile wallets and contactless payment methods, consumers now have the option to make secure transactions using their smartphones or other mobile devices.

Moving Beyond Cash

As digital payments gain traction, the payments industry is moving towards a cashless society. More and more consumers are opting for electronic payment methods such as credit cards, debit cards, and mobile wallets, as they offer increased convenience and security.

Technology-Driven Innovations

The payments industry has seen an influx of technological advancements that have revolutionized the way business transactions are conducted. From payment processing solutions to mobile payment apps, businesses now have a wide range of options to choose from to facilitate secure and seamless transactions.

Embracing Financial Inclusion

Another significant aspect of the payments industry’s evolution is the increased focus on financial inclusion. Mobile payment technology has provided access to financial services for individuals who were previously underserved by traditional banking systems. This has opened up new opportunities for businesses to tap into a wider customer base.

Future Trends

Looking ahead, the payments industry is set to continue its rapid growth and innovation. Emerging payment technologies, such as peer-to-peer payments and the integration of mobile payments with loyalty programs, are gaining momentum. Moreover, businesses need to be aware of the challenges associated with mobile payment implementation, such as security risks and the need for secure transaction measures.

In conclusion, the payments industry has undergone transformational changes, primarily driven by advancements in technology and changing consumer preferences. The shift towards digital payments, the rise of mobile payment solutions, and the focus on financial inclusion are shaping the future of the industry. It is crucial for businesses to stay updated with the latest payment trends and leverage the full potential of mobile payment technology to stay competitive in the evolving business landscape.

Going Cashless Leads the Way for Digital Payment Trends

In today’s increasingly digital world, the trend of going cashless is gaining momentum, paving the way for the adoption of digital payment methods. This shift towards digital payments has significant implications for businesses and consumers alike.

One key advantage of going cashless is the convenience it offers. With digital payment options such as mobile wallets and contactless payments, customers can make transactions quickly and easily, without the need for physical cash or cards. This not only saves time but also eliminates the hassle of carrying bulky wallets or counting change.

Another benefit of embracing digital payments is the improved security they provide. Traditional payment methods, such as cash or credit cards, are susceptible to theft or loss. In contrast, digital payment solutions offer enhanced security features, like encryption and tokenization, to protect sensitive customer information. This reassures customers that their financial transactions are secure and reduces the risk of fraud.

Moreover, going cashless opens up new opportunities for businesses to leverage loyalty programs and personalized offers. Digital payment platforms allow businesses to collect valuable customer data, enabling them to tailor promotions and incentives based on individual preferences. By leveraging data-driven insights, businesses can enhance customer satisfaction and build stronger relationships with their target audience.

As the world continues to move towards a cashless society, businesses that embrace digital payment trends will have a competitive edge. They can tap into a wider customer base, attract tech-savvy consumers, and streamline their payment processes. This not only improves operational efficiency but also positions businesses as forward-thinking and customer-centric.

In conclusion, going cashless is leading the way for digital payment trends, reshaping the way businesses and consumers transact. Embracing this shift not only offers convenience and security but also creates new opportunities for businesses to enhance customer experience and drive growth in an increasingly digital landscape.

Paving the Way for More P2P Payments

In recent years, there has been a significant increase in the popularity and adoption of peer-to-peer (P2P) payments, revolutionizing the way individuals transfer money. P2P payments allow users to send and receive funds directly between their mobile devices, eliminating the need for traditional intermediaries like banks or payment processors. This convenient and secure method of transferring money has paved the way for a new era of financial transactions.

Simplifying Payment Processes

P2P payments have simplified the payment process by offering a quick and hassle-free way for users to send money to friends, family, or even merchants. Users can link their bank accounts or credit cards to mobile payment apps, allowing for seamless transfers with just a few taps on their smartphone screens. This simplicity has made P2P payments an attractive option for many individuals, as it eliminates the need for cash or physical cards.

Enabling Instant Transfers

One of the key benefits of P2P payments is the ability to transfer money instantly. Unlike traditional payment methods that may take several business days to process, P2P payments provide near-instantaneous transfers. This feature is particularly useful in urgent situations or when immediate access to funds is required. Whether it’s splitting a bill at a restaurant or sending funds to a loved one in need, P2P payments offer the convenience of instant transfers.

Facilitating Personal and Business Transactions

P2P payments are not limited to personal transactions; businesses can also leverage this technology to streamline their financial operations. By accepting P2P payments, merchants can offer their customers a broader range of payment options, leading to increased customer satisfaction and loyalty. Furthermore, small businesses can benefit from reduced transaction fees compared to traditional payment methods, boosting their bottom line.

Increasing Financial Inclusion

P2P payments have also played a pivotal role in increasing financial inclusion, especially in underserved populations or regions lacking access to traditional banking services. With a mobile device and an internet connection, individuals can participate in the digital economy and transact with ease. P2P payments have opened up opportunities for individuals who were previously excluded from the formal financial system, promoting economic empowerment and financial well-being.

In conclusion, P2P payments have emerged as a transformative force in the payments industry. The rise of this technology has simplified payment processes, enabled instant transfers, facilitated personal and business transactions, and increased financial inclusion. As the demand for convenient and secure payment methods continues to grow, businesses and individuals alike will need to embrace and adapt to the P2P payment trend for a seamless and efficient financial future.