By max October 12, 2023

When using the QuickBooks software, one of the fundamental things to work is the QuickBooks payment processing system. Whether you are a vendor or a merchant, you should know how to receive and pay for the transactions.

Whether you’re using QuickBooks Online or the Desktop software, this guide specifically outlines the steps for receiving and accepting payments through QuickBooks. Notably, QuickBooks Online offers businesses the versatility to receive payments through a range of methods, including debit and credit cards, bank transfers, Venmo, and PayPal.

A noteworthy convenience of QuickBooks Online is its automatic handling of the receipt and recording of online payments from customers. This seamless integration ensures that your financial transactions are efficiently managed, allowing you to focus on the core aspects of your business operations.

But before jumping directly to the details, let’s understand a bit more about the QuickBooks payments.

QuickBooks Payment Features

Although there are many features of QuickBooks payment processing, here are some of the reasons why this is people’s favorite:

- Invoicing: Invoicing gives businesses the option to integrate a “pay now” button directly into their invoices. Once the payment is initiated by the customer, the funds are deposited into the business’s account the following day. Additionally, businesses receive prompt notifications when clients view or complete their invoices. To further enhance efficiency, businesses can configure recurring invoices, ensuring automatic dispatch to repeat clients.

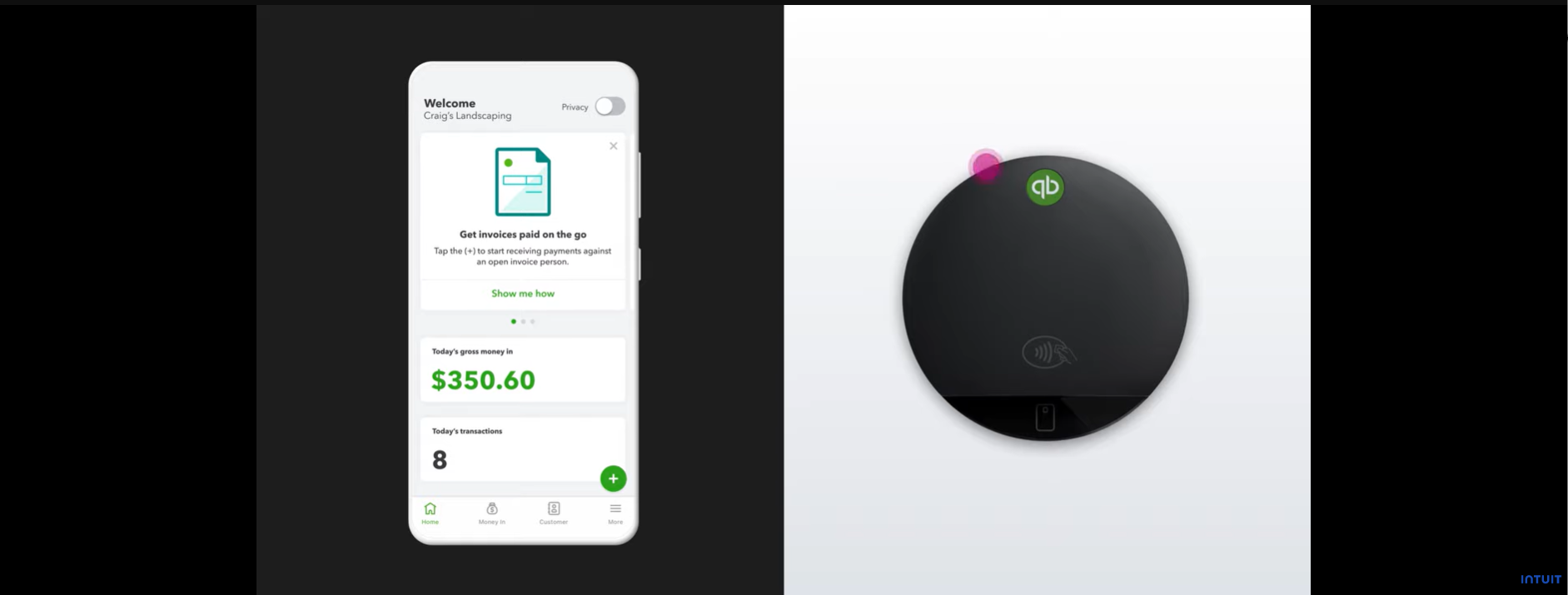

- GoPayment: QuickBooks provides an in-house POS application for smartphones known as GoPayment. This app utilizes QuickBooks for processing both keyed and in-person transactions while on the go.

It is accessible on Android and iOS devices, and it’s noteworthy that the app is free, although QuickBooks credit card processing fees are applicable. Beyond payment processing, the app seamlessly synchronizes transactions with your QuickBooks account, computes and applies sales tax, facilitates the delivery of receipts via email or text, and offers tools for adding and managing sales items.

- QuickBooks Card Reader: The QuickBooks card reader is designed to accept various forms of payment, including dipped and tapped card transactions, as well as digital wallet payments such as Apple Pay and Google Pay.

This compact device features an interactive display, providing customers with transparency regarding their expenses and the option to include tips when appropriate. Notably, the reader is compatible with both Android and iOS devices.

Advantages Of Using QuickBooks For Payments

Let’s start in favor of QuickBooks payment processing. There are compelling reasons to use QuickBooks Payments for your business. Here are the pros :

Convenient

The primary and arguably the most significant justification for integrating with QuickBooks Payments for your business is its convenience. QuickBooks stands as the most extensively used accounting software for businesses.

Using QuickBooks payment processing enables you to streamline your accounts receivable processes by promptly aligning invoices with payments. If you utilize QuickBooks online, you can seamlessly synchronize with your bank accounts, thus saving valuable time during payment entry.

One-Stop Solution

For many business owners, the idea of juggling multiple software programs to handle various financial aspects can be rather intimidating. QuickBooks integrated payments for accepting credit card payments from your customers simplify the process. You can create, send, and accept payments for your invoice on the same platform.

Business owners who prioritize simplicity might find QuickBooks appealing, as it allows them to address the majority of their financial needs in one place.

User-Friendly

QuickBooks is popular because of its user-friendly interface. And being popular also comes with an advantage. You will find most of your customers using QuickBooks. Therefore, the payment process becomes easy.

QuickBooks handles almost all the things related to business management, and therefore, it has become a popular choice.

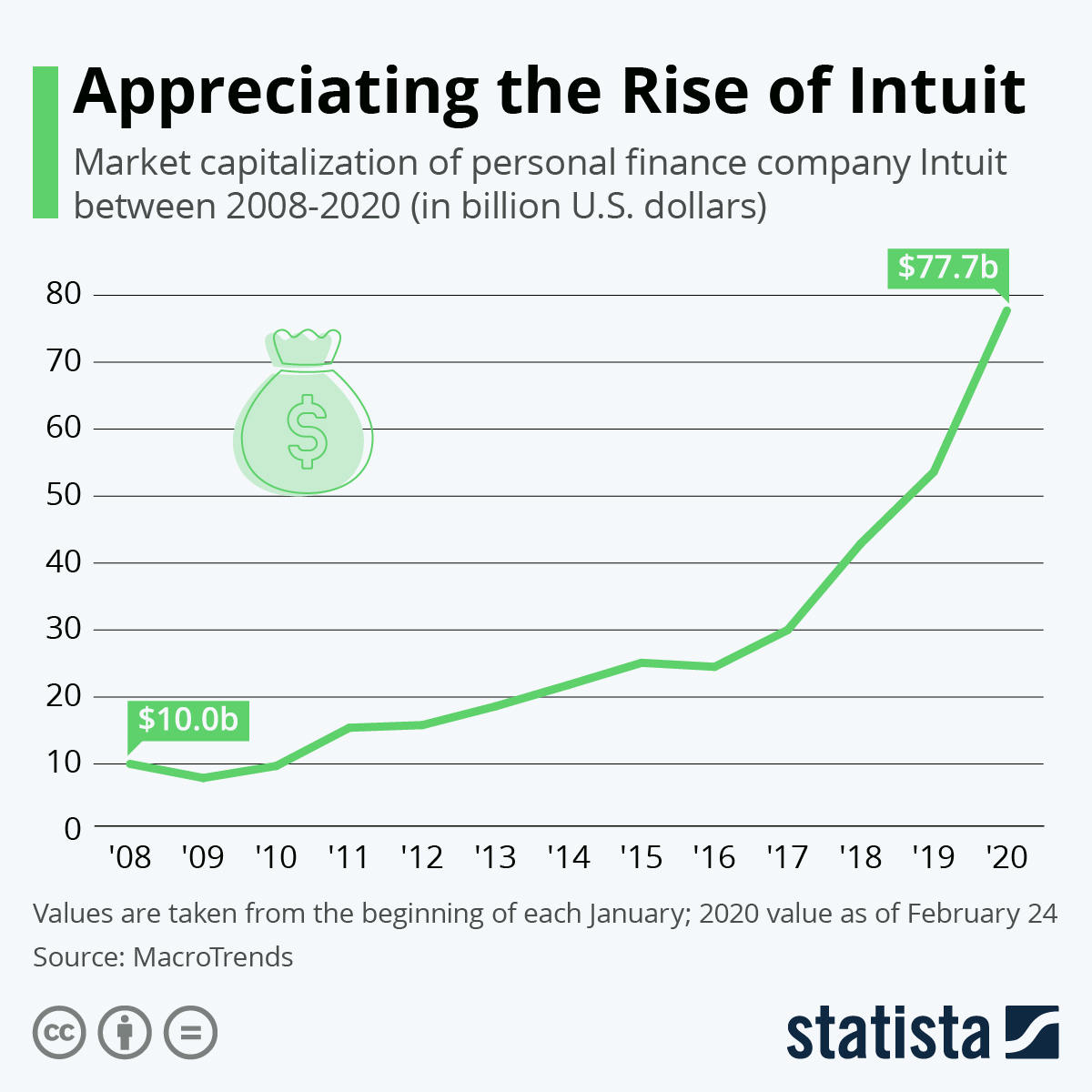

Data source: Statista

Drawbacks of Using QuickBooks For Payments

Here are some drawbacks of using QuickBooks for the payments:

Downtime and Updates

One of the primary challenges associated with using QuickBooks Online is the frequent release of updates by Intuit, the company behind QuickBooks. These updates can lead to slower processing times and even result in temporary account access restrictions. Furthermore, they may create difficulties for your customers when attempting to make payments.

QuickBooks integrated payments may be convenient when accessible, but the availability could become an issue each time a new update needs installation. Additionally, QuickBooks regularly modifies its subscription plans, further complicating the user experience.

Slow Payment Processing and Servers

As mentioned previously, QuickBooks stands as the predominant business accounting software in the United States, with countless other businesses utilizing QuickBooks Online, competing for limited bandwidth resources.

This high user volume results in occasional sluggish processing times within QuickBooks. This can directly impact your ability to efficiently handle payments through QuickBooks, potentially dissuading customers from using the platform due to the value they place on their time.

High Charges

In scenarios where convenience is prioritized, it is common to expect higher costs for services. This same principle applies to QuickBooks integrated payments, where the privilege of offering customers the option to pay online comes at a substantial cost. QuickBooks credit card fees are structured as follows:

- For Credit Cards (Swiped): 2.4%

- For Credit Cards (Invoiced): 2.9%

- For Credit Cards (Keyed): 3.4%

In addition to these charges, you may get charged an additional $0.25 for each method. These charges will directly impact your profit margins if you process the money using any of the above-mentioned methods, especially if a significant portion of your customers choose to pay with credit cards.

How To Setup Payment Processing With QuickBooks?

Setting up online payments within QuickBooks is a relatively straightforward process. Here is a detailed guide to help you get started:

- Begin by logging into your QuickBooks Online account, which will direct you to the QuickBooks dashboard. Locate the gear icon situated in the upper right corner of your screen. Under the “Your Company” section, select “Account & Settings.”

- Within the “Account & Settings” page, you’ll find the “Payments” option on the menu to the left of your screen. Click on it and then select “Learn More” under the “QuickBooks Payments” section. At this stage, you’ll receive an overview of QuickBooks’ online payment processing fees, providing you with a clear understanding of the associated costs.

- To continue, simply click on the “Set Up Payments” button. From there, you’ll be guided through a series of steps to input important information about your business. This includes details like your business name, address, phone number, industry, and type of business. After providing the necessary business information, you’ll also need to provide your personal details, such as your name, date of birth, personal phone number, address, and social security number.

- QuickBooks will provide guidance on every point of the process, from entering the required information for your bank account to where payments will be deposited. After you’ve filled in the necessary details, simply click “Submit.”

With the setup complete, you can now send invoices to your customers. When creating an invoice, you’ll notice two clickable options under the “Payment Options,” one for credit cards and the other for bank transfers.

Understanding The Vendor’s Side – Accounts Payable Process

Accounts payable represent the collective debts your company owes to other businesses for products and services they’ve invoiced you for.

The accounts payable process involves a series of structured steps, starting with the creation of a chart of accounts, vendor details assignment, invoice verification, payment processing, and payment recording.

Step 1: Establish Accounts

The initial phase in the accounts payable process centers around the creation of a chart of accounts, an organizational framework that simplifies the recording of financial transactions.

Within each account category, distinct account names are allocated, each associated with a unique account number and its significance in financial statements. Setting subcategories to further segment and enhance organizational efficiency is also possible. This structured approach streamlines financial tracking and management. Typically, a chart of accounts encompasses five primary account types:

- Equity account

- Asset account

- Liability account

- Income account

- Expense account

Step 2: Vendor Details Assignment

The subsequent phase includes the vendor details, an essential practice for efficient order tracking and adherence to payment deadlines. Additionally, codes are utilized to facilitate the reminder of impending payments.

You can employ various vendor codes to streamline this process, including:

- Net 10: Signifying that payment is expected within ten days.

- Net 30: Signifying a 30-day payment period.

- Net 60: Indicating a 60-day payment period.

The implementation of these codes enhances the organization of accounts payable procedures, offering a clear insight into when payments are due. When employing accounting software for this purpose, it automates monitoring payment terms and the allocation of due dates.

Step 3: Invoice Verification

Prior to proceeding with payment, it is imperative to scrutinize invoices for precision and ascertain that the products or services have been delivered as requested. The three-way match method is an effective approach for validating invoices before disbursement.

The three-way match accounts payable process has been explained below

- Purchase Order: Utilize the official order confirmation to validate the accuracy of quantity, cost, and payment terms.

- Order Receipt or Goods Received Note: Confirm the vendor’s successful delivery of the purchase as ordered.

- Invoice: Validate the exact amount owed and the associated payment terms.

Once you’ve verified the correctness of the invoice and given your approval, the next step is to record the invoice details in your accounting software. This should encompass vital information such as the invoice number, the payable amount, and the due dates, ensuring meticulous documentation and financial clarity.

Step 4: Settling Outstanding Invoices

Having verified the accuracy of your invoices, it’s time to proceed with processing payments for the outstanding ones, ensuring you remit them to the respective vendors. The method of payment may vary depending on your vendor’s preference and the chosen payment avenue. It’s crucial to communicate with your vendors when a payment is in transit, especially if they require notification.

A proactive approach involves conducting a weekly review of your accounts payable to guarantee the absence of any unresolved payments. This weekly check ensures that all obligations are met, and payments are duly processed.

Upon the completion of these steps, it becomes necessary to update your financial records to accurately reflect the latest information. Once a vendor’s payment has been successfully transacted, you can eliminate it from your list of outstanding accounts payable. This process should be performed on a regular basis, ideally once per week, to maintain financial precision and timely payments.

Alternatives To QuickBooks Payments

When seeking payment processing software QuickBooks payment alternatives, several robust options exist. Here, we delve into a few of these alternatives, each catering to specific business needs:

- Stripe: For businesses heavily involved in online operations and dealing with international clientele, Stripe is the best choice. This payment processing solution supports transactions in over 135 currencies, ensuring a global reach. Additionally, Stripe provides 24/7 customer support via phone, email, and chat.

Pricing: 9% + 30 cents per transaction

- Square Payments: Square’s payments platform encompasses various services, including invoicing and even hardware like card readers. It’s adaptable to the unique requirements of different industries, making it one of the best QuickBooks payment alternatives.

Pricing: 9% + 30 cents per transaction

- PayPal Invoicing: PayPal, a well-recognized name globally, offers a seamless invoicing experience. However, customization options may be somewhat limited. It’s worth noting that while there are no monthly fees, the processing fees can be relatively high, which may be a consideration for businesses processing a significant volume of payments.

Pricing: 4.9% + 49 cents per transaction

Frequently Asked Questions

Q: Is QuickBooks Payments a good option?

If you’re already using QuickBooks for accounting, QuickBooks Payments can streamline payment management within the same software. It’s versatile and can accept a wide range of payment options.

Q: How does QuickBooks Payments function?

QuickBooks Payments simplifies payment acceptance for QuickBooks users. You can effortlessly integrate payment buttons or links into your invoices and receive payments through debit cards, credit cards, Venmo, PayPal, and more.

Q: Explain the difference between accounts payable and accounts receivable.

Accounts payable refers to the funds your business owes, whereas accounts receivable represents the amount you anticipate earning from a business transaction.

Q: When can I expect to receive funds after processing a payment through QuickBooks?

For QuickBooks Online users, credit card payments typically deposit within 2-3 business days, while Free Bank Transfers usually take about five business days to deposit.