By alphacardprocess January 24, 2022

An eCheck is a type of electronic payment that allows you to send money using online banking. It is similar to writing a check, but it’s done electronically through your bank. You won’t physically see or touch the eCheck when it’s sent, and the money usually takes one to three business days* (normally less than one day) to be withdrawn from your bank account and deposited in the recipient’s.

When you send an eCheck, it will appear on the recipient’s statement as a “Payment From” followed by your name or business name. This is because funds have to be moved from your account to the recipient’s, which means that there are two parties involved: you and your bank.

After you submit an eCheck payment, both parties have to approve the transaction before it goes through. When funds are moved from one account to another, a hold is put on those funds for a short period of time, which can vary depending on the individual bank policies. The time between authorization and settlement is called the ACH debit delay.

Here is what you should know:

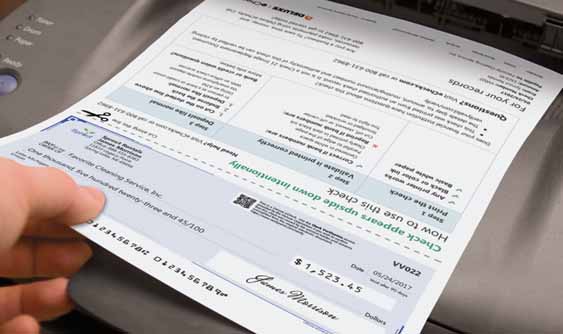

- eChecks, which can also be referred to as “remote checks” and “e-checks”, are electronic payment transactions that use your bank’s online bill pay service, meaning that no paper check or physical money is used in the transaction. This is why they are sometimes referred to as “virtual checks”.

- eChecks are processed electronically, which means that the online bill pay service providers will communicate directly with one another. This is how your bank can verify whether or not the recipient’s account number and other information match up with their records. Banks usually have a process in place for eCheck transactions, but it can vary by bank.

- It can take one to five business days for an eCheck payment to process from the date of submission. This is why it’s important that your customers know when they can expect to receive the funds you send them via eCheck.

- eChecks are a safe and secure way to send and receive money, which is why they have been growing in popularity. Many online bill pay services allow you to save your billing information, which means that the process of sending an eCheck takes even less time and is hassle-free.

- When it comes to eChecks and security: if your bank uses an electronic check conversion (ECC) service, you will be required to enter your routing and account number in order for the transaction to go through. This is not like a bank wire transfer, which requires you to input your full 16-digit checking account number; ECC transactions only refer to the last four digits of this number.

- As a business owner, you can send an eCheck payment to your own business account or to another individual’s account. You don’t have to be set up with the online bill pay service that the recipient is using in order for you to send them an eCheck payment.

- An eCheck will require two parties—the sender and the receiver—to authorize the transaction before it goes through. This is why receiving an eCheck payment confirmation email doesn’t mean that the recipient has actually received the funds. They will need to sign up for a service or have access to someone else’s online bill pay account in order to do so.

- You cannot cancel, edit, or change an eCheck payment after you submit it to the recipient. You can, however, delete it from your bank’s online bill pay service if you wish to void the transaction—just keep in mind that this option isn’t always available.

- When sending an eCheck payment to someone else, they will receive an email notifying them of the incoming funds. This email will include your name or business name, which is why it’s important to double check the information you provide before submitting the payment.

Remember: an eCheck is a safe and secure way to send money online because it requires both parties to authorize the transaction. It may require some time for the recipient to receive confirmation from their bank that the funds have been deposited, but once the ACH debit delay has passed, they will be able to access those funds.