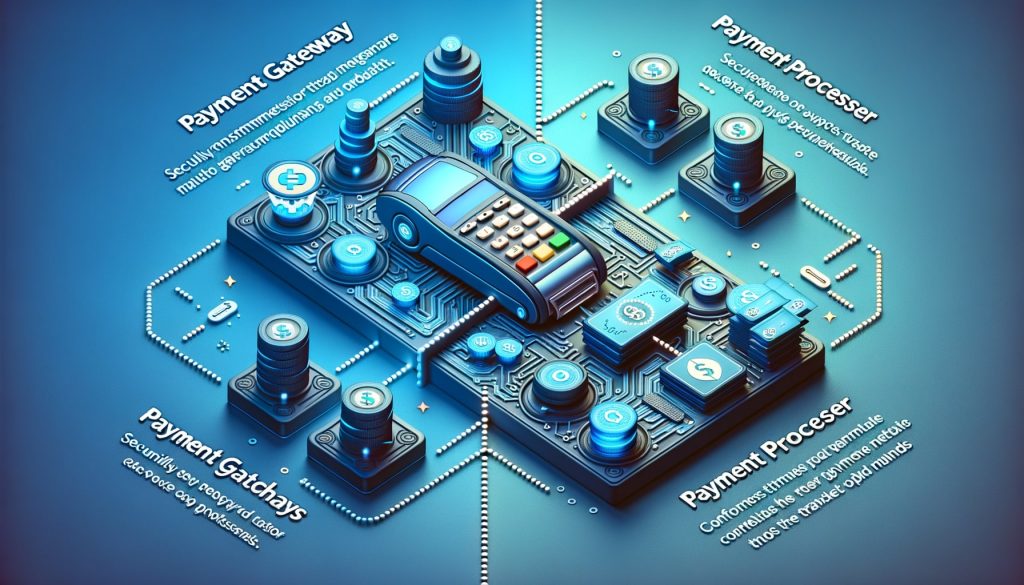

In the realm of digital payments, the terms “payment gateway” and “payment processor” are frequently used but often misunderstood. While they both play essential roles in the transaction process, their functions are distinct. For businesses looking to optimize their online payment systems, understanding the differences between these two components is critical.

This detailed guide will clarify the key differences between payment gateways and payment processors, covering their roles, features, and the essential considerations for businesses. We will also provide a table highlighting the major distinctions to help you make an informed decision about which option is best for your business.

What is a Payment Gateway?

A payment gateway is a technology that acts as a bridge between an online merchant’s website and the financial institutions involved in processing the payment. It securely captures and encrypts customer payment information, authorizes transactions, and facilitates the transfer of funds from the customer’s bank account to the merchant’s account. Essentially, a payment gateway enables the seamless flow of information and funds between the customer, the merchant, and the financial institutions.

How Does a Payment Gateway Work?

When a customer initiates an online transaction, the payment gateway plays a crucial role in ensuring a smooth and secure payment process. Here’s a step-by-step breakdown of how a payment gateway works:

- Customer initiates a transaction: The customer selects the desired products or services on the merchant’s website and proceeds to the checkout page.

- Payment information input: The customer enters their payment details, such as credit card number, expiration date, and CVV code, into the payment gateway’s secure form.

- Encryption and tokenization: The payment gateway encrypts the customer’s payment information to protect it from unauthorized access. It may also tokenize the data, replacing sensitive information with a unique identifier called a token.

- Authorization request: The payment gateway sends an authorization request to the customer’s issuing bank or credit card network to verify the availability of funds and authenticate the transaction.

- Authorization response: The issuing bank or credit card network responds to the payment gateway with an authorization code or decline message, indicating whether the transaction is approved or declined.

- Transaction completion: If the transaction is approved, the payment gateway notifies the merchant, allowing them to fulfill the customer’s order. The funds are then transferred from the customer’s bank account to the merchant’s account.

Key Features and Benefits of Payment Gateways

Payment gateways offer several key features and benefits that make them essential for online businesses. Let’s explore some of these features:

- Security: Payment gateways employ robust security measures, such as encryption and tokenization, to protect sensitive customer payment information from unauthorized access and fraud.

- Seamless integration: Payment gateways are designed to seamlessly integrate with various e-commerce platforms, shopping carts, and mobile applications, allowing merchants to easily incorporate them into their existing systems.

- Multiple payment options: Payment gateways support a wide range of payment methods, including credit cards, debit cards, digital wallets, and alternative payment methods, catering to diverse customer preferences.

- Global reach: Many payment gateways offer multi-currency support and enable cross-border transactions, allowing merchants to expand their customer base and reach international markets.

- Real-time reporting and analytics: Payment gateways provide merchants with real-time transaction data, detailed reports, and analytics, empowering them to gain insights into their sales performance and make informed business decisions.

What is a Payment Processor?

While payment gateways handle the front-end aspects of online transactions, payment processors focus on the back-end processing of payments. A payment processor is a financial institution or a third-party service provider that facilitates the movement of funds between the customer’s bank account and the merchant’s account.

It handles tasks such as settlement, reconciliation, and risk management, ensuring that the funds are securely transferred and deposited into the merchant’s account.

How Does a Payment Processor Work?

Payment processors play a vital role in the payment ecosystem, working behind the scenes to ensure the smooth processing of transactions. Here’s a breakdown of how a payment processor works:

- Transaction submission: Once the payment gateway receives the authorization response from the issuing bank or credit card network, it forwards the transaction details to the payment processor.

- Settlement process: The payment processor initiates the settlement process, which involves transferring the funds from the customer’s bank account to the merchant’s account. This process typically occurs within a specified time frame, known as the settlement period.

- Reconciliation: The payment processor reconciles the transactions, ensuring that the funds are accurately allocated to the respective merchants and that any fees or charges are deducted accordingly.

- Risk management: Payment processors employ sophisticated fraud detection and prevention mechanisms to mitigate the risk of fraudulent transactions. They analyze transaction patterns, monitor for suspicious activities, and implement security measures to safeguard the payment ecosystem.

Key Features and Benefits of Payment Processors

Payment processors offer a range of features and benefits that contribute to the efficient processing of online payments. Let’s explore some of these features:

- Transaction processing: Payment processors handle the complex task of processing transactions, ensuring that funds are securely transferred from the customer’s account to the merchant’s account.

- Settlement and reconciliation: Payment processors facilitate the settlement process, ensuring that funds are accurately allocated to the respective merchants and reconciling any discrepancies.

- Risk management: Payment processors employ advanced fraud detection and prevention measures to protect merchants and customers from fraudulent activities, enhancing the overall security of online transactions.

- Multi-channel support: Payment processors support various channels, including online, mobile, and in-store payments, enabling merchants to offer a seamless omnichannel payment experience to their customers.

- Customer support: Payment processors typically provide dedicated customer support to merchants, assisting them with any payment-related queries or issues they may encounter.

Key Differences Between Payment Gateways and Payment Processors

While both payment gateways and processors are essential to completing a transaction, they perform different functions. Here’s a comparison of their roles, responsibilities, and features.

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Primary Function | Secures and transmits payment data between the merchant and processor | Facilitates the authorization, approval, and settlement of transactions |

| Role in Transaction Process | Handles encryption, fraud detection, and data transmission | Manages fund movement, authorization, and settlement |

| Interaction with Merchant | Provides the merchant with transaction data, fraud tools, and reports | Primarily works behind the scenes with the banks |

| Security Measures | Data encryption, tokenization, and fraud detection tools | Fraud detection, chargeback management |

| Integration | Integrates with e-commerce platforms, POS systems, and apps | Works with banks and card networks for settlement |

| Pricing | Charges per-transaction fees, often flat-rate or percentage-based | Charges based on interchange fees, transaction fees, and processing fees |

| Customer Interface | Interfaces with the customer during checkout (e.g., online forms) | Does not interact with the customer directly |

| Transaction Speed | Provides immediate authorization for online transactions | Handles settlement, which may take 1-2 business days |

| Supported Payment Methods | Credit/debit cards, digital wallets, and alternative payments | Credit/debit cards and bank transfers |

Factors to Consider When Choosing Between Payment Gateways and Payment Processors

When selecting between payment gateways and payment processors, several factors should be taken into consideration. Here are some key factors to consider:

1. Role in the Business

When deciding between a payment gateway and processor, the primary consideration is the type of business you operate and the method by which you accept payments.

- E-commerce: If your business is primarily online, a payment gateway is essential because it captures and encrypts customer payment information. You will still need a processor to complete the transaction, but many services bundle the gateway and processing together.

- Physical Retail: Brick-and-mortar businesses might not need a payment gateway if they use a POS system. In this case, the payment processor manages card-present transactions, which are typically more secure.

2. Security and Compliance

Both payment gateways and processors must comply with the Payment Card Industry Data Security Standard (PCI DSS) to protect customer information. However, gateways typically offer more advanced fraud detection tools such as tokenization and encryption.

- Gateway Features: Look for gateways that offer PCI compliance support, tokenization, and 3D Secure (an added layer of fraud protection).

- Processor Features: Ensure the payment processor offers tools for chargeback management and multi-currency support if you handle international payments.

3. Cost and Pricing Structure

The cost of using a payment gateway and processor can significantly impact your business. Typically, gateways charge per-transaction fees and processors charge a combination of fees, including interchange fees, processing fees, and additional service fees.

- Gateway Fees: These may include a monthly fee, per-transaction fee, or percentage-based fee.

- Processor Fees: These fees can vary based on the card type, transaction volume, and other factors. Compare pricing models, such as interchange-plus, flat-rate, or tiered pricing, to choose the best fit for your business.

4. Customer Experience

A seamless checkout experience is essential for reducing cart abandonment and ensuring customer satisfaction. Payment gateways directly impact the user experience during checkout, while payment processors handle the backend of the transaction.

- Gateway Experience: Choose a payment gateway that integrates with your website and allows for a seamless user experience, whether it’s online, mobile, or in-person.

- Processor Experience: Look for processors that offer fast settlement times, transparent fees, and reliable customer support to ensure smooth financial operations.

5. International Transactions

For businesses that serve international customers, it’s important to choose both a payment gateway and processor that support global payments and multiple currencies.

- Multi-Currency Support: Ensure that your payment gateway and processor can handle transactions in different currencies and support global fraud prevention measures.

- Cross-Border Fees: Be aware of additional fees that may apply when accepting payments from customers in other countries.

FAQs

Q1: Can a single provider act as both a payment gateway and a payment processor?

Yes, many providers offer both payment gateway and processor services, allowing merchants to have a one-stop solution for capturing, encrypting, and processing payments. For example, PayPal, Stripe, and Square provide both gateway and processing services, simplifying the setup for businesses.

Q2: Do all online businesses need both a payment gateway and a payment processor?

Yes, if your business accepts online payments, you will need both a payment gateway and a payment processor. The gateway captures and encrypts customer payment details, while the processor handles the backend approval, fund settlement, and transaction clearing.

Q3: What are the typical fees for payment gateways and processors?

Payment gateways typically charge per-transaction fees, often 2.9% + $0.30 for each transaction. Payment processors charge based on interchange rates, which vary depending on the card type, transaction size, and pricing model. Some processors charge flat rates, while others use tiered or interchange-plus pricing models.

Q4: How does a payment gateway improve security?

Payment gateways use encryption, tokenization, and other security measures to protect customer data during a transaction. They also provide fraud detection tools, such as 3D Secure authentication, to minimize the risk of fraudulent transactions.

Q5: Can I switch payment processors without changing my payment gateway?

Yes, in most cases, you can switch payment processors without changing your payment gateway, as long as your gateway supports multiple processors. However, some all-in-one solutions bundle both services, so switching may require a transition to a new provider entirely. Before making any changes, verify whether your gateway integrates seamlessly with the new processor you plan to use and evaluate potential downtime or service disruptions during the switch.

Q6: How can I ensure that my payment gateway and processor are PCI compliant?

To ensure PCI DSS (Payment Card Industry Data Security Standard) compliance, choose a payment gateway and processor that explicitly state their compliance with these standards. PCI DSS compliance is required for any business handling cardholder data, and both gateways and processors should follow the required security protocols to protect customer information. Ensure that both provide features such as encryption, tokenization, and security patches, and regularly perform audits and assessments of your own systems to maintain compliance.

Q7: What happens if my payment processor or gateway experiences downtime?

If your payment processor or gateway experiences downtime, your ability to process transactions will be disrupted. This can lead to lost sales and frustrated customers. Some businesses use multiple payment gateways or processors to mitigate the risk of downtime, creating redundancy in the system. Many providers also have uptime guarantees and emergency support to address any issues swiftly. Choosing a provider with a track record of high reliability and excellent customer support can minimize these risks.

Q8: Do payment processors handle chargebacks and refunds?

Yes, payment processors typically handle the backend aspects of chargebacks and refunds. When a customer disputes a transaction (e.g., due to unauthorized activity or dissatisfaction with a purchase), the payment processor manages communication between the merchant, the issuing bank, and the acquiring bank. They often provide tools to help merchants respond to chargebacks and may offer dispute management services to help prevent chargeback-related losses.

Q9: How do payment gateways support recurring payments?

Payment gateways that support recurring payments automate the process of charging customers at regular intervals, such as weekly, monthly, or annually. This feature is particularly important for subscription-based businesses. Recurring billing automates the payment cycle and reduces the likelihood of payment delays. These gateways often store customer payment details securely and provide options to manage subscriptions, including upgrades, downgrades, and cancellations.

Q10: Can I use multiple payment gateways and processors in my business?

Yes, using multiple payment gateways and processors is a strategy employed by some businesses to enhance flexibility, improve redundancy, and handle international payments. For example, a business may use one gateway for domestic transactions and another for international transactions that require multi-currency support. Additionally, having multiple providers can offer backup solutions in case one provider experiences technical difficulties or downtime.

Conclusion

Understanding the key differences between payment gateways and payment processors is crucial for businesses seeking to optimize their payment systems. While both payment gateways and processors are essential to completing transactions, they serve different purposes. Payment gateways focus on capturing and encrypting customer payment data, ensuring security and fraud prevention, while payment processors handle the back-end processes of authorization, fund settlement, and moving money between banks.

Choosing the right combination of a payment gateway and processor depends on several factors, including your business model, transaction volume, and customer experience goals. For e-commerce businesses, a reliable payment gateway is crucial for providing a seamless online shopping experience, while physical retail businesses may prioritize selecting a processor that ensures fast settlements and secure fund transfers. In all cases, security, cost, integration with existing systems, and customer support should be top considerations.

By carefully assessing your business’s unique needs, you can choose a solution that ensures smooth and secure payment processing, reducing operational complexities and enhancing the customer experience. Whether you decide on an all-in-one provider that bundles both services or opt for separate solutions, the right choice will help your business grow while safeguarding sensitive payment data.